Pest Control Bookkeeping Simplified (Essential Tips & Tools)

Bookkeeping services in the pest control industry mean accurate records, help with tax compliance, and informed business decisions.

However, many business owners struggle with disorganization, lack of knowledge, or inefficient processes and end up with costly accounting errors and missed opportunities.

This guide is here to help with those pain points, with practical tips and strategies to make bookkeeping easier.

From avoiding common mistakes to using modern tools, you’ll get the know-how to simplify financial management, get organized, and meet compliance for your business needs.

Why Is Bookkeeping Important for Pest Control Businesses?

Bookkeeping is the foundation of any successful pest control business. It means your finances are in order, and you’re compliant with tax laws, avoiding costly penalties and getting valuable insights for business decisions.

Whether you are a small business and do the finances yourself or are fortunate to have a CFO working for you with accurate records, pest control business owners can focus on growth and profitability and deliver excellent pest control services and customer satisfaction.

Good accounting services should help with strategic decisions and aid in:

Business Growth: Accurate financial tracking shows trends so you can identify opportunities to add services, improve pricing, and increase profits.

Tax Compliance: Organized records make tax returns easy and reduce the chance of audits or penalties. Knowing all the information is at your fingertips, you'll have peace of mind. Accurate records also track treatment expenses so you don’t get charged extra to the customer.

Business Decision Making: Access to real-time financial reporting so you can make informed decisions on budgets, cash flow, and investments to streamline the business.

Financial Forecasting: With bookkeeping in order, pest control businesses can forecast seasonal fluctuations and plan for future expenses or equipment upgrades.

Eases Business Management: Automated accounting software combines invoicing, accounts receivable, and expense tracking, saving time and reducing errors.

Now you know the benefits, so let’s get to the components of pest control bookkeeping.

What Are the Key Components of Pest Control Bookkeeping?

Pest control bookkeeping involves tracking the financial activities to keep business running smoothly, tax compliant, and profitable.

Tracking expenses related to pest infestations and problems is required for profitability and service delivery.

Knowing these components means business owners can organize, streamline processes, and make strategic business decisions.

1. Invoicing and Billing

Accurate invoicing means timely payment for pest control services, cash flow, and profitability. Errors in invoices, like wrong amounts or missing details, can delay payment and strain customer relationships.

Best practices include:

Use automated invoicing for real-time accuracy.

Include service descriptions, pricing, and payment terms.

Track unpaid invoices to manage accounts receivable.

Integrated tools like FieldRoutes simplify invoicing, reduce admin hassle, and save you time.

2. Tracking Expenses

Tracking costs like fuel, pest management supplies, and labor is key to profitability. Proper expense tracking helps you identify areas for cost savings and keep your pest control business on budget.

Key techniques include:

Categorize expenses related to common pests like ants, spiders, and roaches for better financial tracking.

Use accounting software to monitor recurring costs.

Review spending regularly to avoid overspending on items you do not need year-round.

This way, your budgets will be accurate and support your financial forecasting for your pest control business.

3. Payroll Management

Timely and accurate payroll means employee satisfaction and labor law compliance. Mismanage payroll, and your pest control business will face fines, increased employee turnover, and inefficiencies.

Improve payroll management by:

Using payroll software to calculate wages, taxes, and deductions.

Keep employee records up to date for accurate payment processing.

Review regularly to ensure tax compliance.

Payroll systems make collecting payments easier and give business owners peace of mind.

4. Financial Reporting

Financial statements like profit and loss reports and balance sheets give you insights into your pest control business. These reports enable data-driven decision-making and tax season preparation.

Key financial reports should include:

Profit and Loss Statements to measure profitability.

Balance Sheets to see assets, liabilities, and equity.

Cash Flow Statements to track liquidity.

FieldRoutes’ software has tools to generate real-time financial reports so business owners can focus on growth and compliance.

By managing these components, pest control businesses can simplify their bookkeeping and gain valuable insights to improve operations and profitability.

What Are the Most Common Bookkeeping Mistakes to Avoid?

Bookkeeping mistakes can lead to financial chaos, missed tax deadlines, and stress for company owners. By identifying and fixing these errors, you can simplify financial management and avoid costly consequences.

1. Failing to Track Expenses or Income Properly

Not monitoring income and expenses creates gaps in financial records, making it hard to measure profitability or prepare tax returns. Unrecorded expenses like fuel for service vehicles or equipment purchases can blow your budget.

You can fix this by:

Using accounting software to track all transactions in real time.

Categorize income and expenses.

Review regularly to ensure everything is accounted for (this could be monthly or quarterly).

Accurate tracking means better forecasting and decision-making for pest control services.

2. Mixing Personal and Business Finances

Mixing personal and business finances makes bookkeeping harder and riskier during tax audits. It’s hard to separate deductible expenses, which can lead to errors or missed deductions.

Prevent this by:

Opening a business bank account and credit card.

Keeping receipts and documentation for all business transactions.

Using bookkeeping templates to keep records tidy.

Separating finances gives you a clear view of your pest control business’s financial health.

3. Not Staying on Top of Tax Deadlines

Missing tax deadlines will get penalties and harm your pest control business’s reputation. Late or incorrect submissions increase the risk of audits.

Stay compliant by:

Setting calendar reminders for tax return due dates.

Working with a CPA or accounting firm that knows pest control accounting.

Using reports that can be tax-ready to simplify the process.

Consistency means your tax obligations are met stress-free.

4. Lack of Regular Reconciliation and Updates

Not reconciling accounts regularly leaves room for errors like duplicate transactions or missed payments. It also affects financial statements.

Improve your reconciliation process by:

Scheduling weekly or monthly meetings to review accounts.

Invoices and accounts receivable are up to date.

Software to match transactions automatically for real-time accuracy.

Reconciliation makes bookkeeping and business owners’ lives that little bit easier.

By avoiding these mistakes, pest control businesses can have efficient bookkeeping, stay compliant, and focus on growth opportunities.

What Are Some Tools and Software to Simplify Pest Control Bookkeeping?

Manual bookkeeping with spreadsheets or paper records is time-consuming and error-prone.

Digital bookkeeping methods like dedicated software are more efficient and accurate ways to track finances. Investing in the right tools can save time, reduce errors, and get real-time financial performance visibility for pest control businesses.

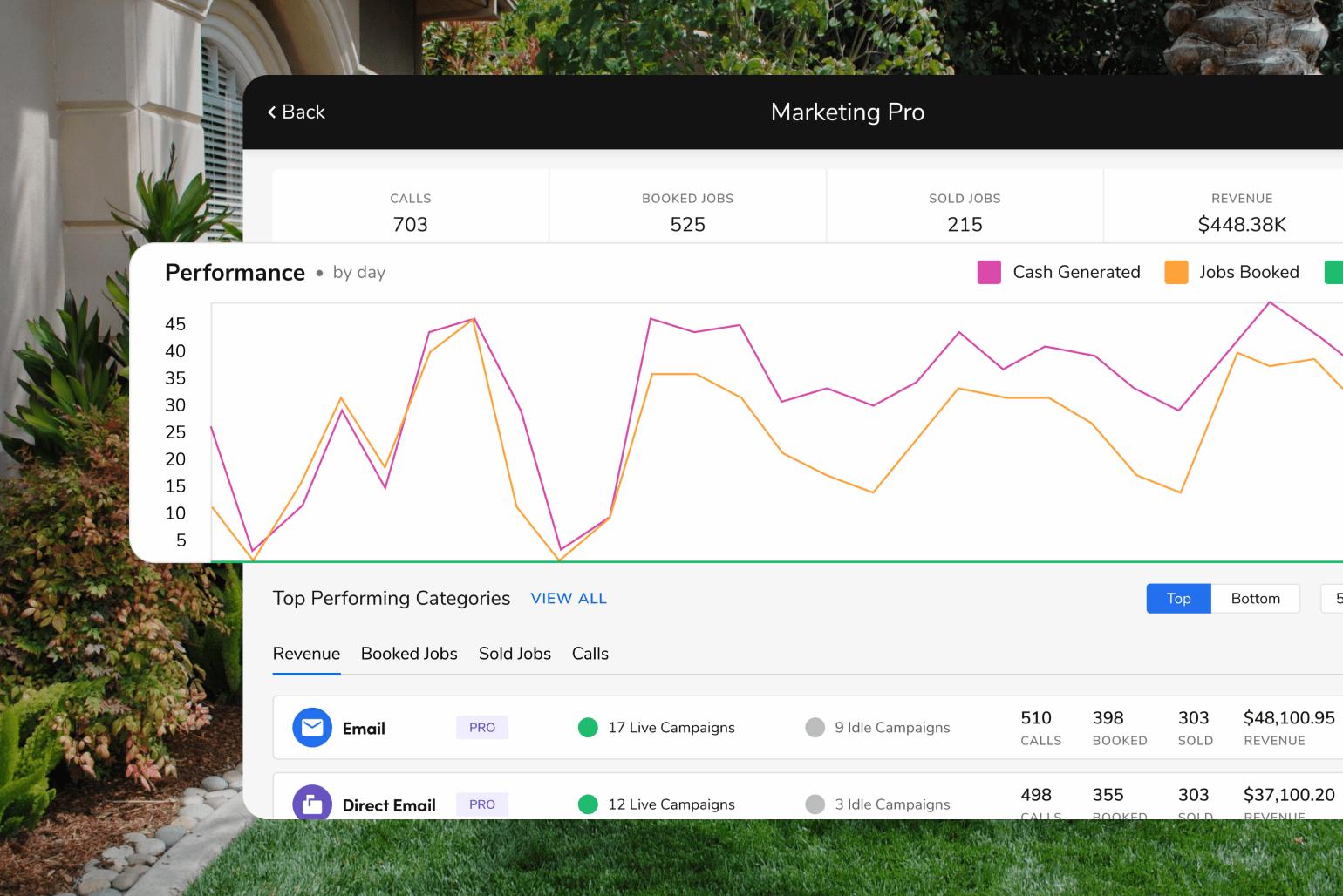

Pest control software like FieldRoutes has bookkeeping and financial management features that combine invoicing, expense tracking, and reporting.

These tools simplify operations, help remind business owners to meet tax deadlines, and increase profitability. Software can also support various services, from single treatments to complete integrated pest management solutions.

Whether you’re moving from manual or upgrading from old systems, digital solutions for pest control businesses can make a big difference. Using software gives you automation, accuracy, and convenience that help you make better decisions.

Let’s see the tools and features to simplify your pest control bookkeeping.

1. Pest Control Software

FieldRoutes is an all-in-one solution that combines invoicing, financial reporting, and cash flow management. Features include:

Real-time tracking of accounts receivable and expenses.

Automated invoicing and billing to reduce manual entry errors.

Financial forecasting tools to support decision-making.

Explore more about FieldRoutes’ software to streamline your business operations.

2. QuickBooks for Pest Control Businesses

QuickBooks has accounting tools for small to medium-sized service businesses, including pest control businesses.

Customizable templates for invoicing and financial reporting.

Integration with payroll to simplify employee payments.

Cloud-based to manage finances on the go.

QuickBooks is a popular choice because of its user-friendly interface and integration with FieldRoutes.

3. Expense Tracking Apps

Tracking Apps like Expensify or FieldRoutes track fuel, supplies, and labor costs. Features include:

Receipt scanning for instant recording.

Categorization of expenses for tax purposes.

Integration with accounting software for automatic updates.

Digital expense tracking so you never miss a business expense.

4. Tax Preparation Software

Tools like TurboTax make tax preparation for pest control businesses easy. Features include:

Automated deductions to save more.

Step-by-step guidance to file compliance.

Integration with financial software for accurate calculations.

Using these tools allows you to be compliant and minimize the hassle of tax preparation.

With the right software and tools, small businesses can manage their books, have peace of mind, and focus on delivering outstanding service.

How FieldRoutes Can Help Streamline Your Bookkeeping

Bookkeeping is key to pest control business owners to save time, reduce errors, and grow.

FieldRoutes is a pest control software that simplifies financial management and business operations.

From automated invoicing to real-time financial reporting, the platform reduces administrative burdens and increases profitability.

FieldRoutes eliminates the headaches of manual bookkeeping by providing integrated tools that increase accuracy, organization, and compliance. Automating repetitive tasks and offering customizable features ensures that bookkeeping is aligned with your business rather than the other way around.

Whether you’re managing accounts receivable, preparing for tax, or creating budgets, FieldRoutes has a solution for pest control businesses.

Let’s see its features and how they can help you with your financial management.

Key Features of FieldRoutes Software

Automated Billing and Invoicing FieldRoutes automates recurring billing and invoicing to reduce errors and ensure timely payment. This keeps your accounts receivable up to date.

Financial Reporting Tools To see how your pest control business performs, generate real-time reports, including profit and loss statements and cash flow forecasts. These reports support data-driven decision-making and tax preparation.

Expense Tracking Track labor, fuel, and pest control supplies with integrated expense tracking—categorize expenses for better budgeting and forecasting.

Tax-Ready Features FieldRoutes compiles and organizes records so you can file tax returns and meet deadlines. This reduces the risk of audits and penalties.

Customizable Dashboards A user-friendly dashboard to see your financial health, including invoicing, accounts receivable, and cash flow.

Benefits of Using FieldRoutes

Error Reduction: Automated processes reduce human errors in invoicing, expense tracking, and reporting.

Time Saved: Streamlined workflows give you more time to focus on delivering outstanding service.

Real-Time Accuracy: Instant access to financial data for better decision-making and profitability.

By using Fieldroutes tools, you can simplify bookkeeping, increase accuracy, and focus on what matters most: growing your business.

It’s Your Turn Now

Bookkeeping keeps your finances organized and compliant with tax and supports data-driven decisions. You can simplify your processes and grow your business by avoiding common mistakes and using modern tools.

Remember:

Use accurate invoicing and expense tracking to grow profitability.

Keep personal and business finances separate to simplify accounting.

Invest in tools like FieldRoutes for automated bookkeeping and financial reporting.

Ready to simplify bookkeeping?

Get a free demo today and see how FieldRoutes can save you time and reduce errors for your pest control business.

Take the first step toward hassle-free bookkeeping. Your pest control company deserves it.