Collecting Payments in Pest Control: A Complete Guide

Getting paid by pest control customers can be tough in the pest control industry.

Late payments, cash flow delays, and old payment methods can be damaging for business owners.

Efficient payment collection is key to cash flow and profitability. This guide will help your pest control company simplify the payment process and give you practical solutions to increase efficiency and customer satisfaction.

We’ll examine online payments, automated reminders, and upfront payment requests. You’ll also learn to simplify invoicing and communicate expectations.

Use these to boost your cash flow, reduce stress, and focus on delivering great pest control services to every homeowner. By the end of this guide, you’ll have actions to take regarding your pest control business today.

Let’s get into it and show you how to make payment collection easy.

1. Embrace Online Payments for Pest Control Services

Online payments are convenient and secure for both pest control businesses and customers. Accepting credit cards, debit cards, and ACH payments means smooth transactions and faster payment processing. Mobile payment options like on-site card readers give you more flexibility and convenience for on-the-go services.

FieldRoutes has the features to help you simplify payment processing.

Online payments through the customer portal and automated reminders aid your business in getting paid on time. The platform automatically updates lost, stolen, expired, and closed credit card information. Better reporting gives you visibility into payment status to address delinquencies and capture missing revenue before it hits your cash flow.

Now, let’s simplify invoicing.

2. Simplify Invoicing

Clear and simple invoicing is key for pest control businesses. Invoicing with online payment links speeds up processing and cash flow. Offering recurring payment options for long-term service contracts simplifies the payment process for businesses and customers. Pest control plans can have simplified invoicing options to increase payment collection.

FieldRoutes has the features to help you simplify invoicing.

Batch payments into groups and use AutoPay to simplify and speed up your process. Get advanced collection tools and automated communications to reduce manual tasks and get paid on time. Automated reminders and easy-to-use online portals increase customer satisfaction with your service business.

Now, let’s talk about automating reminders.

3. Automate Reminders

Automating reminders for upcoming payments is a big win for pest control businesses. Setting up automatic email notifications or SMS text messages means customers know their due dates and reduces the chance of late payments.

Regular pest control treatments are key to effective pest management; automated reminders mean timely payments for those services. Professional and polite communication in these reminders is important to keep customer relationships positive and get paid on time.

FieldRoutes can automate these manual tasks and simplify office work. By getting customers to pay on time, FieldRoutes increases cash flow and reduces delinquencies. Automated reminders save time and effort, so your team can focus on more important things and be more efficient.

Now, let’s talk about asking for payments upfront to take your payment collection to the next level.

4. Ask for Payments Upfront

Asking for payments upfront can reduce the risk of late payments and keep a steady income from your services. Set up a payment system before starting any new service contract.

Offering a discount for upfront payments can be a good strategy for pest control businesses. Determine your pricing for pest control services, then add a 10-25% buffer. When selling to customers, show them the higher price but offer a discount for upfront payment. This gets customers to pay in advance, and you get paid before you start work, so it is a win-win.

Not all customers will pay the total amount upfront, but many will pay a portion, which gives you financial security from the start. This reduces follow-up and keeps cash flow positive.

Now, let’s talk about communicating your payment expectations to customers.

5. Clearly Communicate Your Expectations

Communication is key for pest control businesses.

Before any service, discuss payment methods and timelines with your customers.

Will you accept credit cards, debit cards or other online payment methods?

When will you send the invoice, before or after the service is complete, and when do you expect payment?

Communication is also important for effective pest management, so that pest management can get paid on time and get to infestations quickly.

There should be some level of convenience for both parties. Online scheduling platforms can integrate with credit card processors and require payment before scheduling an appointment. This attracts serious long-term customers and eliminates the need for manual invoicing later, simplifying the payment process for everyone involved.

Also, consider late fees and early payment discounts.

Small percentage fees and discounts can encourage customers to pay on time. However, you must communicate these terms clearly and upfront. Unexpected fees can hurt your relationship with customers, so transparency is key.

Now, let’s talk about sending follow-up emails to get paid on time.

6. Send Polite Follow-up Emails

Sending follow-up emails can improve your pest control company’s accounts receivable and help you respond to infestations quicker. Customers may miss an invoice due to vacations, staffing changes, or email errors.

If a week passes and no payment is received, send a polite follow-up email. Reattach the invoice and keep the tone non-assassinatory. Clearly state that payment is due and remind them of the terms agreed upon in the original contract.

If emails go unanswered, consider more direct communication. A phone or video call usually gets quicker results and shows you’re committed to solving the issue.

Professional and polite follow-ups keep customer relationships positive and get paid on time. This reinforces your business’s commitment to great customer service and simplifies payment.

Now, let’s talk about offering a custom invoice schedule to get paid faster.

7. Offer a Personalized Invoice Schedule

Offering a custom invoice schedule can improve your pest control business’s cash flow and customer relationships. For example, instead of charging a customer $1,500 upfront, consider breaking it into $500 monthly payments for 3 months. This gives customers more flexibility to manage their finances, and you get paid on time.

Custom invoice schedules are part of a complete pest control solution, which also includes custom treatment plans and ongoing preventative measures.

When you propose this adjustment, approach it as a collaboration. Don’t propose a payment plan that’s too tough for the customer to meet, as this will only lead to more delays and late fees. Building trust with your customers is key to long-term success.

A custom invoice schedule meets customers' needs and builds loyalty and satisfaction. This keeps cash flow steady and strengthens customer relationships.

Now, we’ll talk about dropping non-paying customers to keep your pest control business financially healthy.

8. Consider Dropping Non-Paying Customers Altogether

Sometimes, despite your best efforts, a customer will not pay.

In these cases, evaluating whether to keep the relationship is critical. Legal action to recover unpaid bills can be expensive and exceed the amount owed.

Chasing payments takes time and resources away from more profitable work. Dropping non-paying customers can free up your schedule for customers who pay on time and value your pest control services. This can mean a more stable cash flow and better customer relationships.

Dropping non-paying customers can also open opportunities to find new customers who will pay more for quality pest control services. Prioritizing customers who respect payment terms keeps your business financially healthy and stable.

Looking for Ways to Streamline Payments?

Payment collection is key to cash flow and customer satisfaction in the pest control business. Here are some ways to improve your payment process: online payments, simplifying invoicing, automating reminders, and setting clear payment expectations. Custom invoice schedules and dropping non-paying customers can also help your financial health.

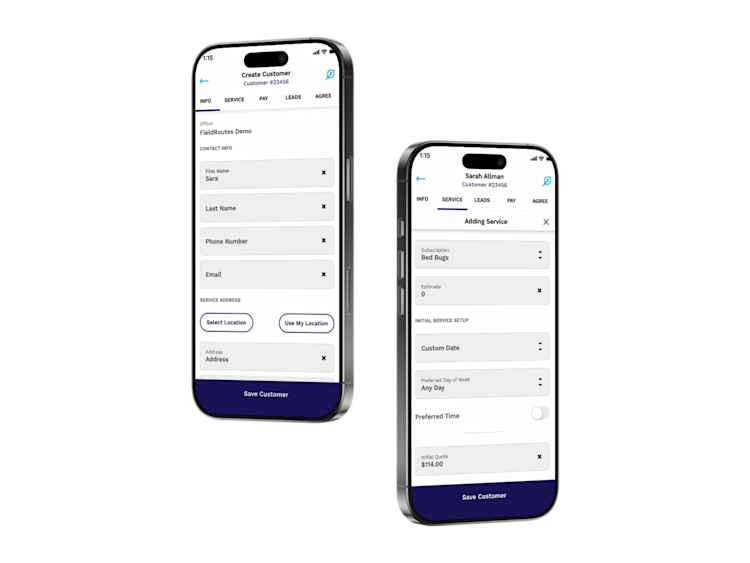

FieldRoutes can help simplify your payment process with features and functionality designed for pest control businesses. Its user-friendly mobile app makes invoicing even more straightforward and helps reduce the number of past-due accounts.

Payment Processing Made Easy:

Adapt to customers’ preferences and get paid faster.

Automate manual processes to streamline office tasks.

Hassle-free Payment Software:

Let software handle payment processing.

Enjoy the benefits of automation.

Agile Billing:

Simplify and fast-track your process.

Batch payments into groups.

Leverage AutoPay and advanced collection tools.

Use automated communications for reminders.

Online Payments:

Save time with online payments through the customer portal.

Ensure timely payments with automatic reminders.

Reduced Risks:

Protect revenue and maintain profitability.

Automatically update lost, stolen, expired, and closed credit card information.

Better Reporting:

Easily view and understand the status of payments.

Address delinquencies and capture missing revenue before they impact cash flow.

Integrate it with your favorite accounting software, for example, Quickbooks.

Try our pest control software to simplify your payment process, boost cash flow, and reduce delinquencies, whether a large enterprise or a small business.

Schedule a free demo for FieldRoutes Operations Suite: FieldRoutes Free Demo.

![10 Pest Control Tools Every Technician & Company Needs [2025]](https://images.ctfassets.net/7i0yc949tatx/7cqTUOBQEUPSU4570lOSRf/be27fcb0297c1dd6fcab89b0a53094a7/FRT-Blog-Best-Pest-Tools-0623-PL.jpg?w=720&h=360&fl=progressive&q=100&fm=jpg)