Pest Control Business Tax Deductions Guide

Managing pest control expenses wisely can significantly reduce your taxable income.

Understanding tax deductions helps business owners maximize savings while staying compliant with IRS tax laws. However, not all business expenses qualify, and misclassifying costs can lead to audits or penalties.

Knowing what you can write off, from vehicle costs to office expenses, ensures you don’t leave money on the table. Similarly, recognizing non-deductible expenses prevents costly mistakes.

Tracking deductions manually can be overwhelming.

That’s where FieldRoutes comes in.

With automated expense tracking, easy reporting, and real-time data insights, FieldRoutes helps pest control businesses stay organized and prepared for tax season.

This guide breaks down the top 20 tax deductions, explains what expenses don’t qualify, and shares tips for maximizing your business tax savings.

What Are Tax Deductions?

Tax deductions reduce your taxable income, lowering the amount you owe in income tax. The IRS allows business owners to deduct necessary business expenses as long as they are ordinary and essential for operations.

For pest control businesses, deductions help offset pest control costs, from vehicle expenses to generally deductible office supplies. Properly tracking these expenses ensures compliance with tax law and maximizes savings.

Why Tax Deductions Matter for Small Businesses

Lower tax liability – Reduce the total amount owed on your tax return.

Increase profitability – Keep more of your earnings for reinvestment.

Stay compliant – Avoid penalties by properly categorizing business tax write-offs.

Common Deductible Expenses

Home office deduction for those working remotely.

Travel expenses related to job sites and industry events.

Depreciation on vehicles and equipment used in pest management.

Knowing what qualifies for a write-off is the first step to optimizing your pest control expenses.

Why Are Tax Deductions Important for Pest Control Businesses?

Tax deductions allow pest control business owners to reduce their taxable income, ultimately lowering their business tax liability.

Claiming all eligible business expenses ensures that you keep more of your profits while staying compliant with IRS regulations.

Without proper deductions, you risk:

Overpaying on taxes – Missing out on legitimate write-offs increases your tax burden.

Non-compliance – Misclassifying business expenses can lead to audits and penalties.

Reduced profitability – Keeping track of pest control costs helps maintain healthy profit margins.

Key Benefits of Tax Deductions

Increase cash flow – More savings allow for reinvestment in pest control services and equipment.

Offset necessary expenses – Reduce costs on travel expenses, professional services, and office supplies.

Improve financial planning – Knowing what to deduct helps the budget for tax season.

Taking advantage of deductions ensures you optimize your income tax strategy while keeping your finances in check.

What Are the Top Deductible Pest Control Expenses for Pest Control Businesses?

For taxpayers, taking advantage of tax deductions helps pest control business owners lower their taxable income while covering essential business expenses.

The IRS allows deductions for ordinary costs necessary for running a pest control company. Expenses for pest control treatments are also deductible, emphasizing the importance of tracking these costs.

Understanding what you can write off ensures you maximize savings during tax season while complying with tax law.

1. Vehicle Expenses

Work vehicles are essential for exterminators traveling to client locations. The IRS allows deductions for:

Mileage driven for pest control services.

Fuel costs for company-owned vehicles.

Routine maintenance like oil changes and tire replacements.

Insurance premiums related to business purposes.

To claim, track your mileage using FieldRoutes or another bookkeeping tool. Either deduct actual expenses or use the standard mileage rate set by the IRS.

2. Employee Wages and Benefits

Paying employees is a necessary business expense. Business owners can deduct:

Salaries and wages for full-time and part-time employees.

Bonuses and commissions tied to pest control services.

Health insurance premiums for employees.

If you hire independent contractors, their payments also qualify as a write-off, but be sure to issue IRS Form 1099 when applicable.

3. Pest Control Supplies

The cost of essential supplies for pest management is deductible. Eligible items include:

Chemicals, sprays, and pesticides are used for treatments.

Bait stations and traps for rodent control.

Personal protective equipment (PPE) such as gloves, masks, and respirators.

Termite treatment expenses for rental and commercial properties, with varying deductibility for home-based businesses.

Tracking these pest control expenses ensures you deduct all necessary materials used for professional services.

4. Tools and Equipment

Tools used in pest control services qualify for deductions, including:

Sprayers, foggers, and bait guns for extermination.

Ladders and inspection tools for termite and rodent control.

Repairs and replacements of broken equipment.

Larger purchases may be deducted through depreciation, spreading the cost over several years.

5. Office Rent or Home Office Deduction

If you lease an office, you can deduct:

Monthly rent payments for office space.

Security deposits and maintenance fees.

Expenses for pest control and landscaping for rental properties are also deductible.

For self-employed individuals using a home office, the home office deduction applies if:

The space is exclusively used for business purposes.

You track workspace expenses like utilities and maintenance.

6. Utilities

Necessary business expenses like utilities qualify for deductions, including:

Electricity and water bills for office spaces.

Phone and internet services for scheduling and customer communication.

Mobile phone expenses if used for work-related calls.

Ensure these expenses are directly related to running your pest control business.

7. Advertising and Marketing

Promoting a pest control business qualifies for multiple tax deductions, including:

Google Ads, PPC campaigns, and SEO – Digital marketing efforts to attract homeowners.

Website design and maintenance – Costs for running a pest control website.

Business cards and promotional materials – Includes flyers, branded uniforms, and vehicle wraps.

Educational materials about common household pests – Informative content to educate customers.

Investing in advertising helps generate new business while providing valuable tax write-offs.

8. Business Insurance

Protecting your pest control company with the right insurance providers ensures financial security. Deductible insurance premiums include:

General liability insurance – Covers damage or injuries caused by pest control services.

Workers’ compensation – Required coverage for employees.

Commercial property insurance – Protects office space and equipment.

These business expenses are crucial for risk management and tax savings.

9. Professional Development

Continuing education expenses qualify as necessary business expenses:

Pest control certifications and licenses – Required by state and local governments.

Industry conferences and workshops – Travel and registration fees are deductible.

Training programs – Employee development and skill-building.

Investing in professional development keeps your business competitive and ensures compliance with industry regulations.

10. Software Subscriptions

Technology simplifies operations, and business owners can deduct:

Scheduling and CRM software – FieldRoutes helps automate appointments and customer management.

Accounting and bookkeeping tools – Track pest control expenses with QuickBooks or other platforms.

Marketing automation tools – Subscription-based email and social media platforms.

Some pest control software includes features for managing treatments that cover the entire home.

Tracking software subscriptions ensures accurate financial reporting for tax season.

11. Office Supplies

Everyday office expenses include:

Printer ink, paper, and envelopes – Day-to-day office needs.

Computers and accessories – Laptops, keyboards, and monitors.

Filing cabinets and storage – Organizing paperwork and business records.

These small business costs add up and qualify as business tax deductions.

12. Business Travel Expenses

Necessary travel expenses qualify for tax deductions, including:

Flights and hotels – Work-related trips for conferences or client visits.

Rental cars and taxis – Transportation costs for business purposes.

Meals while traveling – 50% of business meals can be deducted.

Proper documentation ensures compliance with IRS regulations.

13. Client Discounts and Promotions

Offering incentives to homeowners qualifies as a write-off:

Referral discounts – Encourages new clients through word-of-mouth marketing.

Loyalty programs – Rewards for repeat customers.

Seasonal promotions – Limited-time discounts on pest control services.

These marketing costs help retain customers while reducing taxable income.

14. Licensing and Permits

Government fees necessary for legal compliance qualify as deductible business expenses:

State and federal pest control licenses.

Environmental permits for chemical usage.

Local business registration fees.

Maintaining proper licensing avoids legal complications.

15. Professional Fees

Hiring tax professionals or CPAs ensures accurate financial records. Deductible professional services include:

Bookkeepers and accountants – Help track pest control expenses.

Lawyers – Legal assistance related to business tax compliance.

Consultants – Business advisory services.

These necessary business expenses provide financial stability and compliance.

16. Vehicle Depreciation

Vehicles used for pest control services qualify for depreciation deductions:

New vehicle purchases – Deduct value over time.

Work vans and trucks – Used for transporting equipment.

Fleet maintenance – Covers wear and tear.

Consult a CPA to determine the best method for claiming depreciation.

17. Health and Safety Expenses

Safety-related expenses qualify as business tax deductions, including:

First aid kits and safety training.

Disease prevention measures.

Protective equipment for technicians.

Ensuring a safe work environment reduces liability risks.

18. Loan Interest

Interest on business loans is deductible, including:

Loans for equipment purchases.

Business lines of credit.

Interest on commercial mortgages.

Keeping loan documents organized ensures compliance.

19. Charitable Contributions

Donations made under a business name qualify for deductions, including:

Sponsorships for community events.

Contributions to local charities.

Donations of pest control services for public spaces.

Only donations made to eligible non-profits qualify.

20. Miscellaneous Expenses

Additional business tax deductions include:

Uniforms with logos.

Industry memberships and subscriptions.

Real estate rental costs for storage.

Proper documentation ensures smooth tax return filing.

What Are Some Non-Deductible Expenses to Watch Out For?

Not every business expense qualifies as a tax deduction.

Misclassifying non-deductible expenses can lead to errors on your tax return, increasing the risk of audits or penalties.

Understanding these restrictions ensures compliance with IRS tax laws while optimizing legitimate pest control expenses.

1. Personal Expenses

The IRS does not allow deductions for personal expenses, even if they overlap with business purposes.

Personal vehicle use – If a work vehicle is used for personal trips, only the business-related mileage is deductible.

Non-business travel – Vacation or personal trips cannot be claimed as travel expenses.

Household expenses – Rent, utilities, or landscaping costs unrelated to a home office deduction are not deductible.

Pest problem – Personal expenses related to addressing a pest problem at home are not deductible.

To avoid errors, maintain separate records for personal and business expenses.

2. Penalties and Fines

Any penalties imposed by the IRS or other agencies are non-deductible expenses, including:

Late tax payments – Interest and penalties for overdue income or business tax are not deductible.

Traffic violations – Personal responsibilities include parking tickets and speeding fines for company vehicles.

Non-compliance penalties – Fines cannot be written off for violating pest management regulations or missing permit renewals.

Proper planning helps avoid unnecessary fines that increase pest control costs.

3. Client Entertainment

While business meals are partially deductible, client entertainment is not. The IRS excludes:

Sporting event tickets – Hosting clients at a game is considered a personal expense.

Concerts or recreational outings – Even if business discussions happen, these remain non-deductible.

Luxury experiences – Golf outings, private clubs, or spa trips cannot be written off.

Only business meals with a clear work-related purpose qualify for tax deductions.

4. Political Contributions

Donations to political campaigns, parties, or lobbying efforts are strictly non-deductible. This includes:

Campaign sponsorships – Contributions to a candidate’s campaign.

Lobbying expenses – Payments to influence tax law or regulations.

Political events – Fundraising dinners or rallies for government officials.

To stay compliant, focus on charitable contributions to eligible non-profit organizations instead.

5. Capital Expenses (Directly)

Large business purchases cannot be fully deducted in the year they are acquired. Instead, they must be depreciated over time.

Examples include:

Vehicles – Work trucks and vans qualify for depreciation rather than an immediate write-off.

Office furniture – Desks, chairs, and filing cabinets fall under capital expenditures.

Large equipment – Foggers, sprayers, and other tools with a long lifespan must be deducted gradually.

Using proper depreciation schedules ensures compliance while maximizing business tax savings.

What Are the Most Important Tips for Maximizing Tax Deductions?

Properly managing pest control expenses ensures you claim every eligible tax deduction while avoiding errors that could trigger an IRS audit.

Using the right tools and strategies makes tax season smoother and helps maximize savings.

Keep Detailed Records

Accurate record-keeping is essential for claiming business tax deductions. Without proper documentation, the IRS may disallow expenses.

Use expense tracking software – FieldRoutes simplifies tracking pest control costs in real time.

Keep all receipts – Digital or physical copies help verify business expenses.

Maintain mileage logs – Record work-related trips for travel expense deductions.

Detailed records of expenses for addressing pest problems ensure accurate tax deductions.

Organized records ensure compliance with tax law and streamline your tax return process.

Hire a Tax Professional

Working with a tax professional or CPA helps avoid costly mistakes and ensures proper tax planning.

Maximize deductions – An expert ensures you claim every eligible write-off.

Avoid compliance issues – Tax pros help prevent IRS penalties.

Save time – Focus on running your pest control business, not paperwork.

Hiring a tax expert provides peace of mind and ensures you don’t miss critical tax deductions.

Separate Business and Personal Finances

Mixing personal expenses with business tax deductions complicates record-keeping and may raise red flags with the IRS.

Use a dedicated business bank account – Keep business transactions separate.

Get a business credit card – Simplifies tracking pest control expenses.

Maintain separate bookkeeping records – Prevents confusion when filing your tax return.

Separating finances protects your small business and ensures smooth tax reporting.

Use Tax Software or Tools

Automating business tax tracking reduces errors and simplifies compliance.

FieldRoutes – Automates expense tracking for pest control businesses.

Accounting software – Tools like QuickBooks help manage business expenses.

Cloud storage – Keep digital copies of receipts and financial records.

Expense tracking – Helps track expenses related to managing pests throughout the year.

Using the right tools ensures accurate income tax filings, saving time and reducing stress.

How Can FieldRoutes Simplify Tax Preparation?

Managing pest control expenses efficiently ensures compliance with IRS tax laws while maximizing tax deductions.

However, manually tracking business expenses, generating reports, and organizing finances can be overwhelming, especially for small businesses.

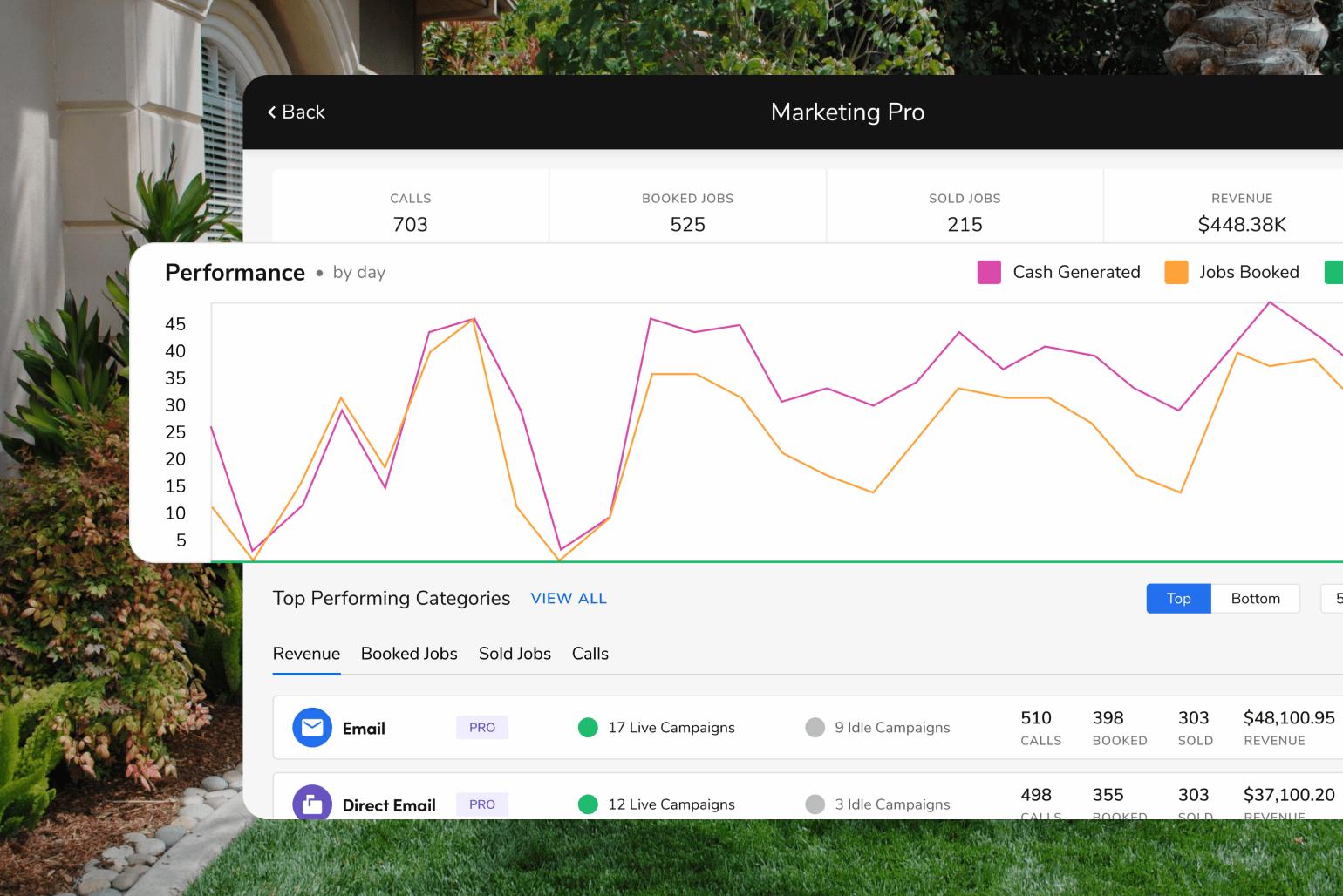

FieldRoutes simplifies tax season by automating expense tracking, integrating with QuickBooks, and generating real-time financial reports. Its features streamline pest control costs, invoicing, and tax return preparation, so business owners can focus on growing their operations rather than worrying about paperwork.

Let’s explore how FieldRoutes makes tax preparation more manageable and helps pest control businesses optimize their business tax strategy.

Automated Expense Tracking

FieldRoutes eliminates the need for manual record-keeping, ensuring accurate financial tracking for tax season.

Track expenses in real time – Automatically logs business expenses related to pest control services.

Categorize deductions properly – Assign costs to necessary business expenses, like vehicle expenses, office supplies, and marketing efforts.

Reduces errors and discrepancies – Minimizes the risk of incorrect tax filings.

By automating expense tracking, pest control companies ensure compliance with tax law while optimizing tax deductions.

Seamless QuickBooks Integration

FieldRoutes integrates directly with QuickBooks, simplifying business tax management and financial reporting.

Sync transactions effortlessly – Eliminates duplicate entries and reduces errors.

Automate invoicing and payments – Streamlines accounts receivable and overdue balances.

Generate tax-ready reports – Provides accurate data for CPAs, tax professionals, and bookkeepers.

A seamless QuickBooks integration ensures that business owners always have updated financial records.

Easy Financial Reporting

Accurate reports simplify tax return preparation and ensure IRS compliance. FieldRoutes helps pest control businesses:

Generate detailed expense reports – Easily track pest control costs, depreciation, and write-offs.

Monitor cash flow and profitability – Identify financial trends and optimize business tax strategies.

Prepare for audits effortlessly – Keep organized records of all tax deductions and necessary business expenses.

Automated reporting allows business owners to file their income tax returns confidently without last-minute stress.

Streamlined Invoicing and Payments

FieldRoutes simplifies pest control business finances by:

Automating invoice generation – Reducing delays in collecting payments.

Tracking outstanding balances – Minimizing past-due accounts.

Reducing administrative workload – Freeing up time to focus on lead generation and customer service.

A pest control company can maintain accurate records while improving cash flow and tax efficiency.

Maximize Tax Savings with FieldRoutes

FieldRoutes ensures pest control businesses:

Claim all eligible deductions – Tracks business expenses to avoid missing tax deductions.

Reduce tax liabilities – Helps lower taxable income through proper write-offs.

Stay audit-ready – Keeps records organized for compliance with IRS regulations.

By integrating expense tracking, tax reporting, and financial automation, FieldRoutes simplifies tax season and enhances financial management for pest control business owners.

It’s Your Turn Now

Maximizing tax deductions helps pest control businesses lower costs and comply with IRS regulations. Tracking business expenses, using QuickBooks integrations, and working with tax professionals ensure accuracy during tax season.

Want to simplify tax preparation and streamline expense tracking? FieldRoutes makes managing pest control costs easier with automated reporting and financial tools.

Take control of your finances today.

Schedule a free demo to see how FieldRoutes can support your pest control business.