Pest Control Business Insurance Essentials: Types & Costs

Pest control business insurance refers to the various types of coverage designed to protect pest control companies from financial losses related to accidents, damages, and lawsuits.

This specialized insurance protects your business, staff, and clients.

Insurance can benefit pest control contractors by mitigating the risks associated with property damage, bodily injury, and other liabilities arising from daily operations.

Without proper coverage, one lawsuit could devastate your company financially.

Contractors ' key pest control insurance types include general liability, workers’ compensation, commercial auto insurance, and professional liability coverage.

These policies address common risks in the pest control industry.

What is Pest Control Business Insurance?

Pest control insurance is a package of policies that protects pest control businesses from various risks associated with their work. This includes coverage for property damage, bodily injury, and potential lawsuits related to pesticides and fumigation.

Let’s break it down:

General liability covers bodily injury or property damage.

Workers comp covers medical and lost wages for employees injured on the job.

Professional liability for negligence or errors in service.

Having the right coverage is crucial for pest control operators. The cost of pest control insurance can vary depending on your business's size, location, and the specific services you offer.

Pest control contractors looking for the best insurance provider for their needs should consider coverage options, pricing, additional insured, and the provider’s reputation within the industry.

Why Do Pest Control Contractors Need Insurance?

Pest control contractors face unique risks every day.

Whether it’s hazardous chemicals like pesticides, property damage, or bodily injury, having the right insurance policy can protect your business from costly lawsuits or medical bills.

Pest control companies need an insurance program for:

Pesticide exposure risks

Liability policy that includes property coverage for property damage or personal injury on a client’s property.

State regulations or client contracts

Commercial property insurance for business property risks.

Insurance protects both large and small businesses from the unexpected.

What Types of Insurance do Pest Control Contractors Need?

Pest control contractors face many risks, and having a certificate of insurance will be needed before you begin any pest control work. The right combination of policies will cover you in case of accidents, mistakes, or unexpected events.

The main types of insurance pest control companies should consider are:

1. General Liability Insurance

General liability coverage includes third-party bodily injury, property damage, and advertising injury. If a client gets injured on your job site or you accidentally damage their property, this policy will help pay for legal costs and settlement fees.

General liability is a base policy for many pest control businesses. It’s good for everyday operations where accidents happen, such as a slip-and-fall or damage to a customer’s property.

2. Professional Liability Insurance

Professional liability insurance (also known as errors and omissions or E&O) insurance protects you when a client claims your pest control services were inadequate or caused financial loss. This type of coverage is for when a mistake, oversight, or failure to deliver results leads to a lawsuit.

For pest control operators, this policy covers the costs of defending negligence claims or failure to perform service.

3. Pollution Liability Insurance

Pollution liability covers claims related to environmental damage caused by your pest control services, such as pesticide contamination or fumigation.

This coverage helps pay for clean-up, property damage, and health-related claims related to exposure to toxic chemicals.

This type of insurance is key for pest control companies as many of the substances used in extermination services are harmful to the environment and human health.

4. Tools and Equipment Insurance

Tools and equipment insurance covers the cost of repairing or replacing tools and equipment if they are stolen, damaged, or vandalized. This coverage is especially important for pest control businesses that use expensive equipment to operate daily.

By insuring your equipment, you can reduce downtime and avoid costly replacements in case of theft or damage.

5. Commercial Auto Insurance

Commercial auto insurance protects pest control companies when a business vehicle (like a service van) is involved in an accident. It covers vehicle repair, property damage, and medical expenses related to the accident.

Many states require commercial auto insurance for business-owned vehicles, so this policy is a must for pest control contractors who travel between job sites.

6. Pest Control Liability Insurance

Pest control liability is specific to exterminators and pest control businesses and covers risks unique to the industry. It covers damage from fumigation or pest treatment and liability from pesticide use.

This coverage is key to addressing the industry-specific risks that pest control services face, including client property damage and health risks from chemicals.

7. Worker’s Compensation Insurance

Workers’ compensation insurance covers medical expenses and lost wages if your employees are injured on the job. Most states require workers' compensation for businesses with employees, including pest control companies.

This insurance helps pay medical bills and provides rehabilitation and disability benefits so your business is not sued for employee injuries.

8. Inland Marine Insurance

Inland marine insurance covers tools and equipment in transit from one job site to another. This type of insurance covers damage or loss during transit, which is especially important for pest control operators using mobile equipment.

Inland marine insurance covers your tools and equipment while in transit, giving you peace of mind as you travel between service locations.

Choosing the right insurance with appropriate policy limits for your pest control business means evaluating your specific risks and ensuring coverage.

Are There Insurance Requirements for Pest Control Contractors?

Yes, pest control contractors must meet specific requirements based on their state to get an insurance quote for their services. These requirements help protect pest control companies and comply with local regulations.

Some states may require specific coverage types, while others may be at the business owner’s discretion. Here are standard insurance requirements for pest control businesses:

In many states, general liability is required by law to cover third-party bodily injury and property damage.

Worker’s compensation is required for pest control companies with employees to cover work-related injuries.

Commercial auto is required for business-owned vehicles used by pest control contractors for transportation or on-site service.

In some cases, additional coverage, such as pollution liability, may be required based on state regulations or client contracts.

Pest control operators should always check local laws to ensure they meet all insurance company requirements before making any future claims.

How Much Does Pest Control Insurance Cost?

Pest control insurance can cost from $350 to $800 annually for standard plans. You can typically expect to pay between $500 and $3,000 for more specialized services, like termite or bed bug control.

The cost of pest control insurance varies on:

Business size: Larger pest control companies with more employees or higher revenue pay more.

Services offered: High-risk services like fumigation or termite treatment will cost more.

Location: Different states have different insurance requirements, affecting the overall cost.

Other factors, like your claims history and the types of coverage you choose, will also impact the price. Pest control operators should compare quotes from multiple insurance providers to find the best option for their business.

Pest control contractors should consider bundling policies like general liability and property insurance to get more affordable options.

How Pest Control Software Gives Added Protection

Pest control software can provide extra protection by helping pest control contractors streamline operations, monitor assets, and reduce risks. In addition to traditional pest control insurance, software solutions like FieldRoutes can improve safety and operational efficiency.

Key features that help safeguard your pest control business include:

Fleet Management: FieldRoutes’ fleet management software reduces accident risk by 75% by monitoring driver behavior and real-time risk detection. By tracking vehicle usage and driver patterns, pest control operators can minimize accidents, lower insurance premiums, and keep vehicles in top shape.

FieldRoutes Mobile App: The FieldRoutes mobile app allows pest control technicians to update job information, report equipment issues, and monitor pesticide usage in real time. This level of visibility ensures contractors can stay compliant with regulations, avoid costly mistakes, and reduce claims related to equipment damage or improper pesticide handling.

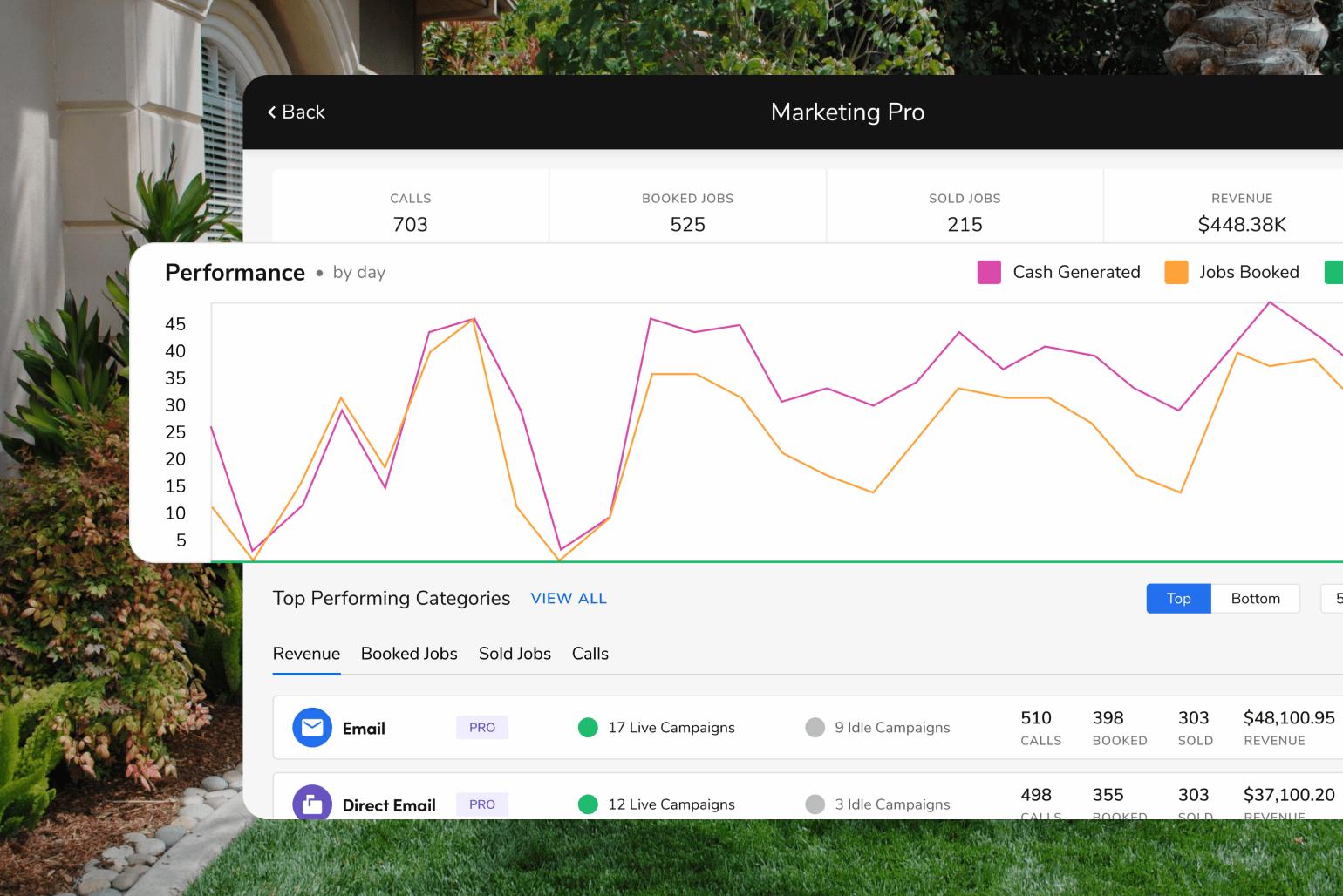

Dashboards and Reporting: FieldRoutes’ dashboards and reporting capabilities allow pest control companies to track key metrics like job site activities, vehicle usage, and staff performance. This data helps operators identify and mitigate risks like overuse of chemicals or unsafe driving habits, which can impact liability coverage and insurance costs.

By using pest control software to improve safety, compliance, and operational efficiency, pest control companies can reduce their risk and obtain more protection from traditional insurance.

Pest control software solutions can benefit contractors looking to manage their business better and protect against liability claims.

How Can You Choose The Best Insurance Provider for Your Pest Control Business?

Choosing the best insurance for your pest control business means finding one that offers full coverage, competitive rates, and industry knowledge.

Here are some to consider:

Coverage options: Ensure the provider offers pest control insurance coverage, general liability, professional liability, and pollution liability.

Compare costs: Get multiple quotes and compare rates, but don’t just go for the cheapest option—balance cost with coverage.

Policy details: Read the terms, conditions, and exclusions. If you have questions, consult with an insurance agent.

By following these tips, pest control operators can choose a provider that fits their business and gives them peace of mind.

Streamline Operations with FieldRoutes

FieldRoutes helps pest control contractors streamline their business by offering a range of tools to improve efficiency, reduce risks, and increase profitability.

FieldRoutes allows you to manage your entire business, from fleet management to real-time reporting. The platform has features like driver behavior monitoring, mobile apps for technicians, and detailed dashboards to track performance, allowing you to reduce operational costs and boost productivity.

Ready to ensure the safety of your pest control business operations?

Schedule a free demo of the FieldRoutes Operations Suite today to see how it can benefit your company.