Cash vs. Accrual Accounting for Pest Control Businesses

Selecting the right accounting method is key to any pest control business.

Whether you’re just starting or want to fine-tune your financials, understanding the difference between cash and accrual accounting can greatly affect your cash flow, financial stability, and tax planning.

Cash accounting is simple, so it’s a popular choice for small business owners in the pest control industry. It only records transactions when money changes hands, giving you a clear picture of your bank account and cash flow.

Cash accounting records income and expenses when money changes hands, while accrual accounting records income and expenses when earned or incurred, regardless of payment timing.

Larger companies or those who want to follow generally accepted accounting principles (GAAP) often prefer this method.

In this article, we’ll examine the pros and cons of each, when they’re best for pest control businesses, and how tools like FieldRoutes can help with financial management for long-term growth.

What is Cash-Based Accounting?

Cash-based accounting, also known as the cash basis, is a simple way of recording financial transactions.

Revenue is recognized when cash is received, and expenses are recorded when paid. This method focuses on the immediate cash in and out of your business and gives you a clear and straightforward view of your bank balance.

For example, a pest control company using the cash basis would log income when a customer pays for services, whether cash, credit card, or check. Expenses like buying chemicals or paying employees are only recorded when the payment is made.

It helps business owners understand their current cash flow so they can cover their daily expenses without overextending themselves.

Key features of cash-based accounting:

Tracks actual cash on hand, so you get a real-time financial position.

It simplifies bookkeeping so that you can manage it without extensive accounting knowledge.

Suitable for smaller pest control businesses with simple transactions.

While simple, this method doesn’t give you a complete picture of your long-term financial health, so it's not ideal for businesses looking to grow.

Let’s look at when pest control businesses should use cash accounting.

When Should Pest Control Businesses Use Cash Accounting?

Cash accounting is a good choice for certain pest control businesses, especially those that want simplicity and real-time cash flow management. This method is best for smaller operations or sole proprietors with simple financials.

Here are the scenarios where cash accounting is good:

Small or Sole Proprietor Businesses: Pest control businesses earning under $25 million per year can use the cash basis. It’s suitable for companies that don’t need complex financial reporting.

No Inventory: If you don’t carry inventory, cash accounting simplifies financial management by focusing on cash transactions, not inventory.

Cash-Only: Cash-only businesses find this method uncomplicated for logging income and expenses.

Tax Benefits for Small Business: Cash accounting helps you match revenue with expenses in the tax year to manage your income taxes and keep your financial records accurate.

Real-Time Cash Flow: Cash-based accounting gives pest control business owners a clear view of their cash flow, enabling them to decide on bill payments and equipment purchases.

Cash accounting suits businesses focused on daily cash flow rather than long-term forecasting.

Next, we’ll examine cash accounting’s limitations and why it may not suit every pest control business.

What Are the Downsides of Cash Accounting for Pest Control Businesses?

While cash accounting is simple, it has several drawbacks that can affect a pest control business’s ability to manage its financial position. This method focuses on cash flow only and often overlooks other financial details that give you a complete picture of the business.

Here are the limitations:

No Insight into Accounts Receivable and Payable: Cash accounting doesn’t track outstanding invoices or unpaid bills, so you don’t get an accurate picture of your accounts receivable or accounts payable. This can lead to cash flow surprises.

Inaccurate Financial Position: Ignoring accrued income or expenses in cash accounting doesn’t give you an accurate view of your pest control business’s assets and liabilities.

Not Suitable for Long-Term Planning: This method doesn’t support financial planning or forecasting without capturing future revenue or obligations.

Compliance Limitations: Larger businesses or those that need to meet GAAP standards may not use cash accounting as it omits critical financial data.

Tax Complexity: Mis-matching revenue and expenses in the tax year can cause inefficiencies in managing income taxes and net income.

For example, if a pest control business provides services in December but isn’t paid until January, the income won’t be recorded in the correct tax year under the cash method.

While cash accounting is good for smaller pest control businesses focused on short-term cash flow, those looking to grow and achieve financial clarity may need a more detailed approach.

Now, let’s examine how accrual accounting addresses these limitations and gives you a more accurate view of your pest control business’s financial position.

What is Accrual Accounting?

Accrual accounting records revenue when it’s earned and expenses when incurred, regardless of when cash is received or paid. This is called the accrual method and gives you a full and accurate view of your business’s financial position, matching revenue and expenses to the period they occur.

For example, if a pest control business provides services in December but doesn’t get paid until January, accrual accounting would record the revenue in December. If the company receives an invoice for supplies in January but pays in February, the expense will be recorded in January.

You should consistently use the cash or accrual method to avoid complications, especially during audits.

Key features of accrual accounting:

Accounts Receivable (A/R): Tracks money owed to your pest control business for services provided.

Accounts Payable (A/P): Tracks money your business owes to vendors or creditors for goods and services received.

Full Financial View: This gives you an accurate view of income, expenses, and liabilities beyond cash in hand.

GAAP Compliance: Meets FASB standards, so it suits businesses that must comply with GAAP.

This method benefits pest control businesses by giving them more financial clarity, which is vital for long-term planning, tax preparation, and net income.

Let’s look at scenarios where pest control businesses should use accrual accounting for more financial clarity.

When Should Pest Control Businesses Use Accrual Accounting?

The accrual method of accounting is best for pest control businesses that need a complete view of their financial position. This method gives detailed income, expenses, and liabilities, so it suits larger corporations or those doing credit transactions and long-term planning.

GAAP (Generally Accepted Accounting Principles) is a set of accounting rules and procedures for accurate financial reporting. These rules are required for publicly traded companies and regulated industries but also voluntary for other organizations that want to maintain financial transparency and consistency.

Here are scenarios where accrual accounting is applicable:

Credit Transactions: Businesses that accept credit card payments or offer credit to clients will benefit from accrual accounting. It tracks revenue and expenses even when payments are delayed.

Assets and Liabilities: Accrual accounting tracks assets like inventory or short-term investments and liabilities like unpaid invoices or expenses.

Preparing for Growth: For businesses expanding their operations, accrual accounting gives you the financial clarity to make informed decisions.

GAAP Compliance: Larger pest control businesses or those looking to go public must comply with GAAP, which requires accrual-basis accounting.

Financial Reporting: Accrual accounting gives you an accurate view of your business’s financial situation by matching income and expenses to the period they occur so that there are no financial statement discrepancies appearing on balance sheets and income statements.

Better Tax Planning: This method aligns financial reporting with tax strategies, ensuring accurate income tax calculations and better preparation for tax obligations. Hence, no issues occur with the IRS or other financial accounting standards boards.

For example, if a pest control business provides recurring services to a long-term client, accrual accounting tracks revenue and expenses accurately so that profitability can be seen over time.

Accrual accounting gives pest control businesses a clear view of their financial position, enabling them to better plan for growth and manage liabilities.

What Are the Downsides of Accrual Accounting?

While accrual accounting gives you a full financial picture, it also brings complexities pest control businesses can struggle with. The method requires detailed tracking, ongoing management, and often additional resources to implement correctly.

Here are some drawbacks:

Increased Complexity: Accrual accounting requires precise record keeping, including tracking accounts receivable, accounts payable, and accrued expenses. Business owners who are not familiar with this method will find it overwhelming.

Cash Flow Mismatches: This method records revenue and expenses when they occur, not when cash is exchanged. A pest control business may look profitable on paper with many gross receipts but struggle with cash flow if payments are delayed.

Time-Consuming Processes: Maintaining accurate records over time requires a lot of time, which can be exhausting for small business owners.

Higher Costs: As your business grows, you may need to outsource to a CPA or invest in advanced accounting software, which will increase expenses.

Not Suitable for Small Operations: For businesses with simple cash flows or limited resources, the time and cost of accrual accounting may not be worth the benefits.

For example, a pest control business managing large commercial accounts will have long delays between service and payment, making cash flow management difficult even with grand financial statements.

Accrual accounting is best for businesses that can manage the complexities and need a complete financial picture.

Now, let’s compare the pros and cons of cash and accrual accounting to decide which is right for your pest control business.

Cash vs. Accrual: Which is Right for Pest Control Businesses?

Pest control businesses face unique financial challenges, such as seasonal cash flow fluctuations, prepaid service agreements, and managing recurring contracts. These factors impact how revenue and expenses are recorded, so the choice between cash and accrual accounting is key to financial clarity and growth.

Accrual accounting is recommended by International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) as the standard accounting practice.

Most companies, except very small businesses and individuals, use it.

Cash accounting is simple and gives you immediate cash flow visibility, so it’s good for small pest control businesses. Accrual accounting gives you a full financial picture so you can track accounts receivable and accounts payable, which is good for larger or growth-oriented companies.

Feature | Cash-Basis Accounting | Accrual-Basis Accounting |

Business Size | Ideal for small business owners with straightforward operations. | Best for larger companies managing credit transactions and multiple assets. |

Income Taxes | Reports income and expenses when cash changes hands. | Reports income and expenses when incurred, offering tax planning advantages. |

Invoice Tracking | Tracks invoices only when settled. | Tracks invoices as accounts receivable, updating their status until paid. |

Vendor Payments | Acknowledges payments only when made. | Records bills as liabilities, even before payment is made. |

Financial Insights | Provides a limited view, focusing only on immediate cash availability. | Offers an accurate picture of the financial position, supporting long-term planning. |

Compliance with GAAP | Does not meet GAAP standards. | Aligns with GAAP, making it suitable for companies aiming for public investment. |

Implementation Complexity | Simple and low-cost to implement. | Requires more time, resources, and possibly a CPA for proper management. |

Cash-basis accounting is good for businesses that want simplicity and real-time cash flow visibility. In contrast, accrual accounting is ideal for companies that need a detailed and accurate financial position.

Choosing the correct method depends on your pest control business size, growth stage, and financial management needs.

How Can FieldRoutes Help Pest Control Businesses with Accounting?

FieldRoutes helps pest control businesses by providing a robust cloud-based platform that simplifies financial management and supports both cash and accrual accounting.

With its advanced automation tools and customization features, FieldRoutes ensures accurate financial tracking, streamlined transactions, and actionable insights for making smarter financial decisions.

Key Features and Benefits of FieldRoutes for Accounting

QuickBooks Integration: FieldRoutes integrates with QuickBooks Online and automates bookkeeping tasks like tracking business expenses and creating real-time financial reports.

Customizable Reports: Generate reports to analyze financial performance, track accounts receivable and accounts payable, and track cash flow or accrued expenses.

Automated Invoicing: Auto-generate and send invoices, add late payment fees and reduce delinquent payments with batch processing and real-time updates.

Online Payments: A customer portal for payment collection, online payments, and AutoPay to improve cash flow.

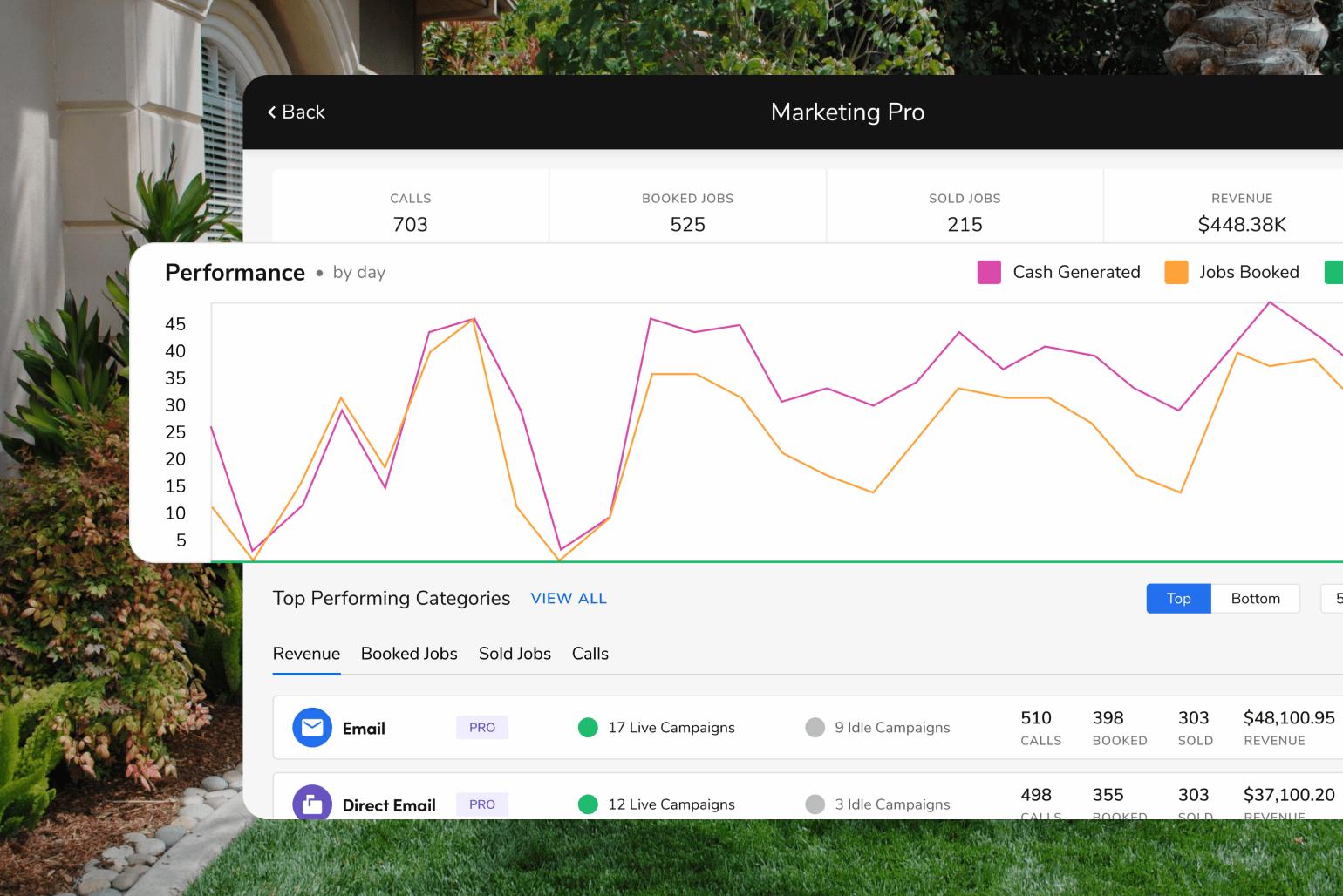

Data-Driven Dashboards: Visual charts and graphs show financial health and align financial reporting with long-term goals.

API Integrations: Integrate with third-party systems for customization and tailor solutions to your business needs.

Supporting Both Cash and Accrual Accounting

FieldRoutes works with your preferred accounting method, cash or accrual.

By automating revenue recognition, expense tracking, and payment updates, the platform ensures financial accuracy regardless of your accounting method.

For example, a pest control business with recurring contracts can use FieldRoutes to track accrued revenue and expenses and automate invoice generation for immediate cash flow management and long-term planning.

The Bottom Line

Choosing the correct business accounting method is important for pest control businesses.

Cash accounting is straightforward and gives you immediate cash flow visibility, while accrual accounting gives you a complete financial picture for long-term planning and compliance. The choice between the two depends on your business size, financial goals, and operational needs.

International Financial Reporting Standards (IFRS) insist that accrual accounting be used to provide an accurate picture of a company’s financial position.

Both have pros and cons.

Smaller businesses may do well with cash accounting, but accrual accounting is necessary for financial reporting as the company grows. Consult a CPA or financial expert to determine what’s best for your pest control business.

Regardless of the method you choose, Using FieldRoutes helps with financial management. FieldRoutes automates bookkeeping, streamlines invoicing, and provides insights into accounts receivable, payable, and cash flow. These features save time and reduce errors, and they are tailored to your business.

Take the next step in optimizing your financial processes.

Schedule a free demo today and see how FieldRoutes can change your accounting.