Pest Control Profit & Loss Statement Template (+Free PDF Download)

Keeping track of income, expenses, and profit allows business owners to make informed decisions and improve their overall performance.

However, managing all that financial data can be tough, and if accurate records are not kept, your company will surely suffer from financial mismanagement.

One tool for better management is our Profit and Loss (P&L) statement, which gives you a snapshot of your business’s financial health.

In this article, we’ll show you how to use a P&L statement and provide a free template to help you track your finances.

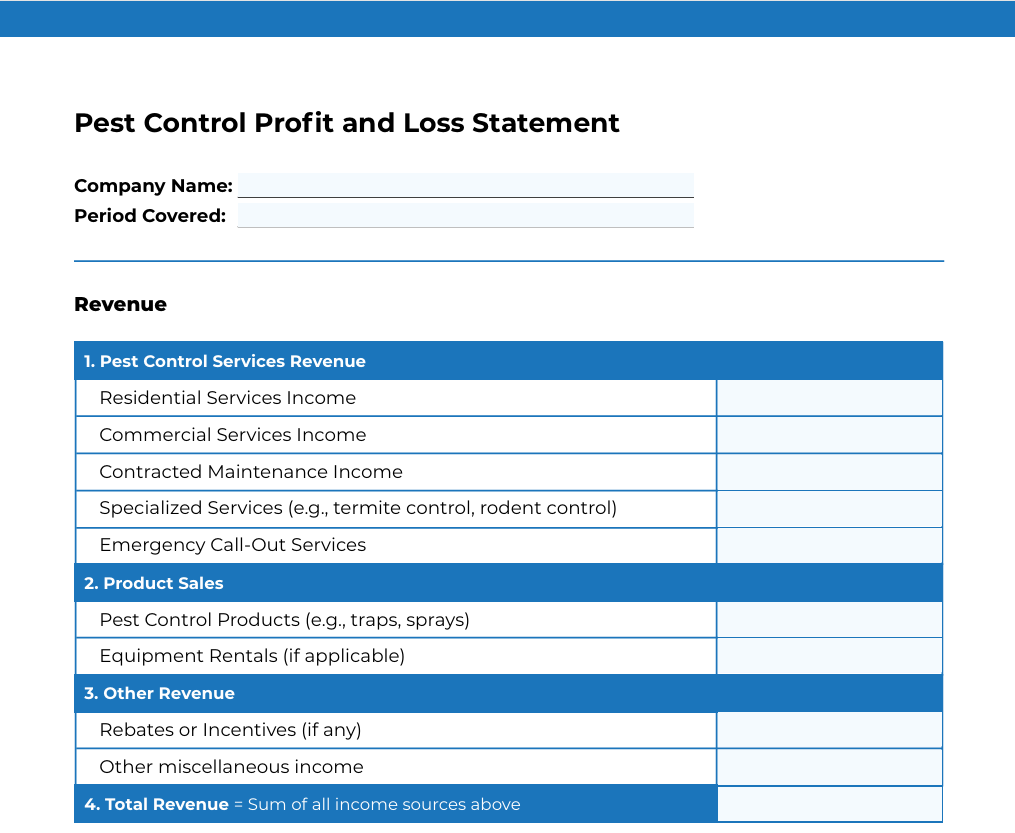

[Download the Free Pest Control Profit and Loss Statement Template]

How to Use Our Free Pest Control Profit and Loss Statement Template

Our free Profit and Loss (P&L) statement template is designed to help pest control business owners track their income and expenses, giving them a clear view of their financial performance.

You can use an Excel spreadsheet for your financial plan, but it can be limiting and requires you to enter formulas to make the spreadsheet work effectively.

However, our template will do all this for you and includes the balance sheet, income statement, and cash flow statement in one place, allowing you to make better financial projections.

Moreover, this template is easy to use and can be customized to suit your business, whether you offer residential pest control, termite treatments, or other services.

To get the most out of the template:

Customize income categories: Add revenue streams such as pest control services, termite inspections, or any other income your business generates.

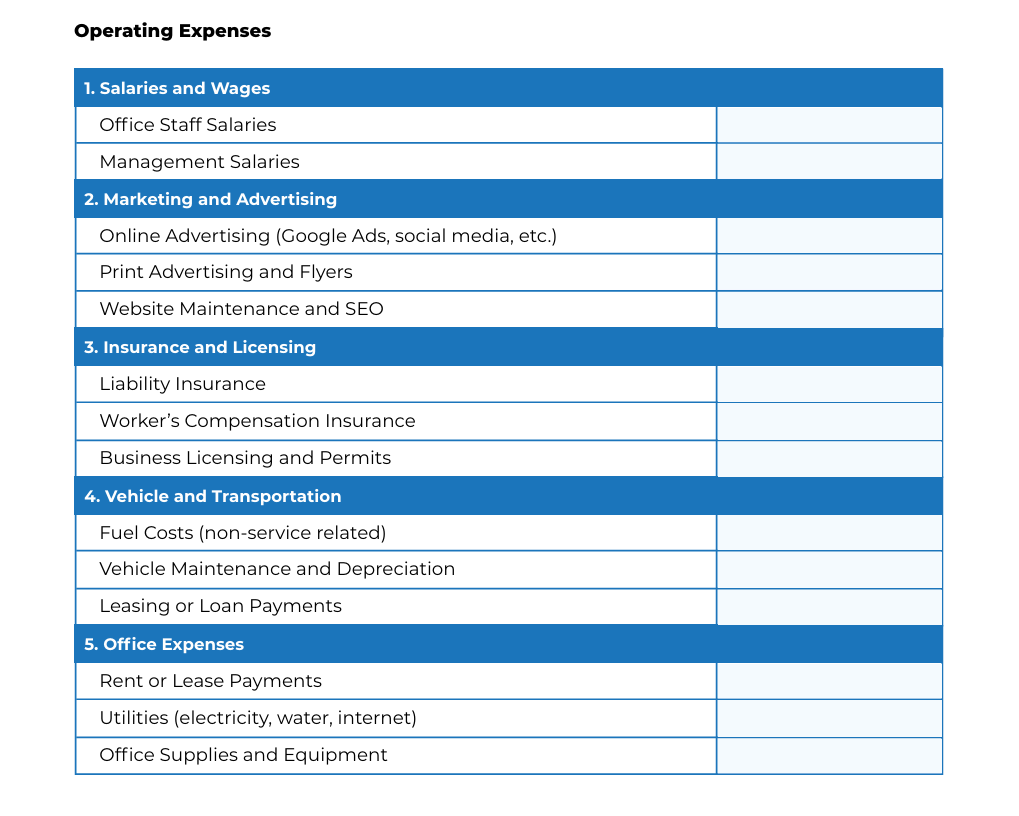

Track operating expenses: Enter costs like pesticides, employee salaries, fuel, and office expenses to see your operating costs.

Add business-specific expenses: Tailor expense categories to include costs unique to your business, such as marketing strategies or equipment depreciation.

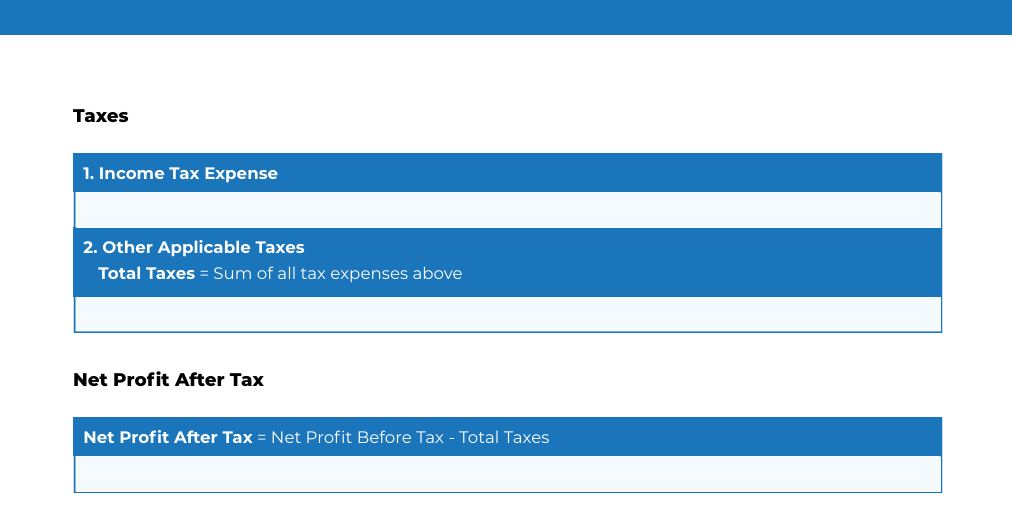

Monitor net profit: Calculate your net income by subtracting total expenses from total revenue.

Adjust for branding: When sharing with lenders or team members, update the template with your business name and logo for a more professional look.

Using this pest control business plan template, you’ll better understand your pest control business’s financial health and where to improve.

With regular use, the P&L statement will become one of your business’s top financial management tools for making data-driven decisions.

What is a Profit and Loss (P&L) Statement?

A Profit and Loss (P&L) statement is a financial document summarizing a company’s income, expenses, and net profit over a certain period, such as monthly, quarterly, or annually. It’s a snapshot of your pest control business’s financial performance, whether it is profitable, operating at a loss, and will break even.

Key components of a P&L statement include:

Revenue: Total income from pest control services, landscaping, and other services provided to homeowners. Simply put all pest management customer payments.

Expenses: All costs of running your business, such as operating expenses, employee wages, pesticides, and marketing.

Net Profit: The difference between total revenue and expenses is the business’s overall profit.

Reviewing a pest control business’s P&L statement regularly helps business owners and entrepreneurs see their financial health, track profit margins, and identify areas to save costs or grow revenue.

It also gives you valuable insights into adjusting your pricing or forecasting future financial performance, which is dependent on the pest control market.

Why Does My Pest Control Business Need a P&L Statement?

A Profit and Loss (P&L) statement is essential for managing your startup or small business in the pest control industry.

It gives you a clear and detailed view of your income, expenses, and overall profitability, enabling you to make informed decisions to drive business success. Here are the reasons why you need a P&L statement.

1. Improved Financial Visibility

A P&L statement lets you track all income and operating expenses to see your business’s financial health in real time. By reviewing the P&L statement, you can:

See where your money is coming from and where it’s going.

Make quick financial decisions.

See profitability at a glance by comparing total revenue to expenses.

This level of visibility means you can monitor your financial performance and make adjustments to maintain healthy cash flow.

2. Informed Decision-Making

Your P&L statement can inform your business decisions by providing data. For example, by looking at financial statements, you can:

See your top-performing services, such as termite control or residential pest control.

Allocate resources and adjust your pricing strategy to reflect actual performance.

Use historical data to forecast future financial performance and set realistic business goals for your ideal target market.

Making data-driven decisions puts you ahead of the competition and aligns your business strategies with real-time insights.

3. Expense Management

A detailed P&L statement makes it easier to manage and reduce your expenses. By looking at the breakdown of your operating costs, you can:

See where you can cut costs, like optimizing pesticide usage or streamlining staffing.

Create a precise budget for future spending.

Cut waste without sacrificing the quality of your pest control services.

Accurate cost management allows your business to run more efficiently and increase profit margins by controlling unnecessary costs.

4. Enhanced Profitability

Reviewing your P&L statement regularly helps you maximize profit margins by seeing how revenue compares to expenses. With this information, you can:

Adjust your pricing to increase profitability while staying competitive. It offers multiple payment options, such as credit cards and PayPal.

Focus on high-margin services, like bed bug treatments or termite inspections.

Make data-driven decisions to increase revenue consistently.

When you monitor profitability closely, it’s easier to grow your pest control business and improve overall financial performance.

5. Simplified Tax Preparation

Your P&L statement makes tax time easier by giving you accurate date financial records. It helps you:

Calculate tax liabilities by looking at income and expenses.

Stay compliant with tax regulations and make audits painless.

Claim all deductions by having a record of expenses and operating costs.

With a full P&L statement, tax preparation is more efficient and reduces the risk of errors, so you stay compliant with all regulations.

6. Financial Accountability

A P&L statement promotes accountability by giving you a clear record of your business’s performance. This accountability builds trust and transparency with your stakeholders. With regular P&L reviews, you can:

Review regularly and adjust as needed. Add in the latest market research for certain types of pest infestations.

Give financial reports and an executive summary to lenders, investors, or partners.

Encourage a culture of proactive financial management within your team.

Keeping your finances accountable means your pest control business is on track for growth.

Now you know the benefits of using your P&L statement to improve financial performance, increase efficiency, and grow your pest control business.

What Are the Most Common Mistakes to Avoid When Using a P&L Statement?

Common mistakes can undermine the effectiveness of a P&L statement. By avoiding these mistakes, you can ensure your financial statements give you accurate information about your business.

1. Inaccurate Data Entry

Mistake: Entering the wrong figures for revenue or expenses is one of the most common mistakes when managing a P&L statement. Number errors, whether due to manual entry mistakes or missing transactions, can obviously have a big impact on your finances.

Impact: Inaccurate data means poor decision-making. You can’t accurately calculate your profit margins, track cash flow, or plan for future expenses.

Solution: Check all entries before finalizing the report. Use financial software or tools that automate data entry and reduce human error. Consistency across all records means your financial reporting is accurate and trustworthy.

2. Failing to Update Regularly

Mistake: Many business owners don’t update their P&L statements regularly. Leaving too long between updates means you have old financial data.

Impact: Old financial data means you can’t make informed decisions in real time. You may miss trends or not adjust your pricing or spending based on your business’s current financial position.

Solution: Set a regular schedule to update your P&L statement, monthly or quarterly. Keeping your financial statements up to date means you always have a clear picture of your pest control business’s performance.

3. Overlooking Small Expenses

Mistake: Ignoring or neglecting small, insignificant expenses like office supplies or small business fees is a common mistake when managing finances.

Impact: Small expenses add up over time and can have a big impact on operating expenses and, ultimately, net profit. Overlooking these costs gives you an incomplete picture of your overall expenses.

Solution: Record all expenses, no matter how small, to have an accurate and complete financial picture. You’ll know how these expenses affect your pest control business’s profitability by tracking all costs.

4. Misclassifying Revenue and Expenses

Mistake: Incorrectly categorizing revenue or expenses can distort your financials. For example, misclassifying operational costs as capital expenses or mixing up income from different services like residential pest control and commercial contracts can be confusing.

Impact: Misclassification means you misunderstand your financial statements and cannot make informed business decisions. Inaccurate decisions based on misclassifications can lead to tax issues, inaccurate forecasting, and poor resource allocation.

Solution: Familiarize yourself with the correct accounting categories and record income and expenses in the right sections. If unsure, consult a financial professional to ensure correct classification.

5. Not Analyzing the Data

Mistake: Focusing on data entry without reviewing the information in your P&L statement is another mistake. This leaves valuable insights unexplored.

Impact: You may miss opportunities to increase profitability or reduce operating costs without reviewing them. Trends in pest control business performance may go unnoticed, and you may be spending more on expenses than you need to.

Solution: Review your P&L statement regularly to identify trends, opportunities, and areas for improvement. Use the data to adjust your pest control services, pricing, and marketing strategies to increase net income and overall business performance.

By avoiding these mistakes, you can get the most out of your P&L statement and keep your pest control business healthy.

Going Beyond Templates: Streamline Your Pest Control Business Operations

While a Profit and Loss (P&L) statement is essential for tracking financial health, using automated tools can take your business to the next level.

The FieldRoutes Operations Suite is a complete solution for simplifying and automating your pest control business’s financial management and operations.

With real-time analytics and reporting dashboards, you can monitor your cash flow, income, and operating expenses in one place. FieldRoutes also simplifies payment processing so you can manage transactions efficiently and spot issues before they hit your bottom line.

Key FieldRoutes features include:

Dashboards & Reporting: Get instant visibility into your financial performance with detailed reports and metrics.

Payment Processing: Automate invoicing, online payments, and billing reminders, reduce manual errors, and get paid on time.

Real-Time Analytics: See financial trends and data in real time to make faster decisions and accurate forecasting.

Learn more about FieldRoutes and how it can optimize your financial management.

Using FieldRoutes will simplify your operations, increase profitability, and ensure the long-term success of your pest control business.

Back to You

Financial management does not always have years of experience in writing a profit and loss statement. However, good finances are pivotal in growing your pest control business. The free Profit and Loss (P&L) statement template lets you track your income, expenses, and overall profitability to make informed decisions.

For a more straightforward approach, the FieldRoutes Operations Suite has tools to automate financial management, including real-time reporting, payment processing, and analytics. This will help you be more productive and profitable.

Download your free P&L statement template and take the next step by scheduling a free demo.