How to Hire a Pest Control Accountant (+What To Look For)

Pest control business owners have unique financial challenges like seasonal revenue fluctuations, specialized regulations and inventory management.

Finding an accountant who gets it can be tough.

Hiring a pest control accountant can mean better financial health, cash flow, and business decisions.

This guide will clearly explain the step-by-step process for finding and hiring the right financial professional for your pest control business.

Why Does My Pest Control Business Need an Accountant?

Running a full-time pest control company means overcoming several financial challenges that require specific knowledge.

Seasonality and Cash Flow Fluctuations: Managing cash flow in the off-season is tough.

Inventory Management and Tracking: Tracking pesticides and equipment requires accurate recordkeeping.

Regulatory Compliance and Reporting: Following industry-specific regulations is crucial to avoid penalties.

Tax Implications Specific to the Industry: Understanding tax deductions and credits can save your business money.

A pest control accountant can help your business operations by ensuring financial stability and compliance.

Now, look at the benefits of hiring a pest control accounting specialist.

What Are the Benefits of Hiring a Pest Control Accounting Specialist?

Hiring a pest control accounting specialist can improve your business’s financial health and efficiency.

1. Deep Industry Expertise

A specialist accountant knows the unique financial challenges of the pest control industry, like seasonal revenue fluctuations, inventory management complexities and industry-specific regulations.

They will know the pest control business to implement financial strategies that reduce risks and improve cash flow and overall financial health so your business can grow.

2. Proactive Financial Guidance

A specialist accountant will provide you with tailored advice and strategies to improve cash flow, manage the off-season and maximize profitability all year round. Their proactive approach will ensure your pest control business is financially strong even in tough times. By anticipating financial issues and fixing them before they become problems, you can make informed decisions supporting long-term growth.

3. Tax Optimization

A pest control accountant knows the tax deductions and credits specific to the industry so you pay the right amount and avoid costly mistakes. Their knowledge of tax laws and regulations will help them find tax savings you would have otherwise missed. This will not only reduce your tax liability but also your business’s financial burden. Optimizing your tax strategy will contribute to your pest control business’s overall profitability so you can keep more of your hard-earned money.

4. Financial Forecasting and Planning

A specialist accountant will help you create realistic budgets, project future revenue and identify potential financial risks. This will enable you to make informed business decisions that support long-term success and stability in the pest control industry.

By creating accurate financial forecasts, they will help you plan for growth, manage cash flow and prepare for any financial challenges that may arise. Their expertise in financial planning will ensure your pest control business is financially strong even in uncertain times.

5. Regulatory Compliance

A specialist accountant is up to date with pest control industry regulations and will ensure your business is compliant with all financial reporting and tax obligations. This will prevent potential legal issues and protect your business from fines and penalties. Their knowledge of industry-specific regulations such as pesticide use and safety will ensure your finances align with all applicable laws.

6. Strategic Growth

A specialist accountant will review your financials, identify growth opportunities and create strategies to grow your pest control business while maintaining financial stability. Their advice is invaluable in helping you make informed decisions on where to invest and how to scale. Their strategic advice will ensure sustainable growth and align with your overall business goals.

7. Peace of Mind

Having your finances in the hands of an expert who knows the pest control industry will allow you to focus on the core of your business and customer service. With a specialist accountant handling your financials, you can spend more time running your business knowing that your financials are safe.

8. Improved Efficiency

A specialist accountant can simplify financial processes, automate tasks and implement systems that will save you time and resources. This will mean cost savings and smoother operations so your pest control business can run more efficiently.

9. Valuable Insights

A specialist accountant will provide regular reports and analysis that will give you a clear view of your financial position, highlighting areas for improvement and how to get new contracts. These will help you stay ahead of the competition and make strategic decisions for your pest control business.

By monitoring your financial performance closely, they will identify trends and patterns you may not have seen. This will allow you to act before issues arise and capitalize on opportunities so your business remains competitive and profitable.

10. Strong Partnership

A good accountant becomes a sounding board, providing ongoing support and guidance as your business grows. This partnership will ensure your financial strategies align with your business goals for long-term success.

By working with you, they will gain an understanding of your business and its unique challenges. This will allow them to give you personal advice and solutions that are specific to you. As your business grows and changes, their ongoing support will ensure your financial strategies remain effective and aligned with your goals.

What Qualifications Should a Pest Control Accountant Have?

Choosing the right accountant means evaluating specific qualifications to ensure they meet your pest control business needs.

Education

A degree in accounting or a related field is preferred for your pest control accountant. A CPA or CMA certification is a bonus; they have more experience and expertise to handle complex financials. These qualifications mean they have a solid foundation in accounting principles and practices, which is critical for managing the unique financial challenges of a pest control business. An accountant with this level of education and certification can provide financial management services specific to your industry.

Experience

Look for several years of accounting or finance experience, preferably in the pest control industry or similar. Proficiency in accounting software like QuickBooks is essential, as is experience preparing financial statements, using Excel, managing accounts payable and receivable and preparing taxes for small businesses. An accountant with experience will be able to handle your finances more efficiently.

Industry-Specific Knowledge

A good candidate will have knowledge of pest management, including recurring revenue models, service contracts and the operational costs of chemicals, equipment and vehicle expenses. They will be familiar with the regulations around pesticide use, safety and licensing and how these impact financial reporting and compliance in the pest control industry. This know-how will allow them to tailor their services to your business and align all financial practices with industry standards and regulations.

Additional Desirable Qualifications

Analytical skills are critical for digging into financial data, identifying trends and providing advice to improve your business.

Communication skills are important to explain complex financials to non-accountants so you get clear and actionable advice.

Being proactive, problem-solving, client-focused, and committed to building relationships and personal service is also important for a partnership with your pest control business. These nice-to-haves will mean the accountant can provide full financial management services for your business to grow and succeed.

Now that you know what to look for, where can you find the right pest control accountant for your business?

Where Can I Find Qualified Pest Control Accountants?

Finding the right pest control accountant means leveraging industry-specific resources and networks.

Pest Control Industry Associations: Many associations, like the NPMA, have directories or referral networks for professionals with pest control experience.

Online Accounting Directories & Social Media: Use these platforms to search for accountants with experience in pest control or similar industries.

Networking: Attend industry events or conferences to meet accountants who know your business.

Referrals: Ask other pest control businesses or trusted advisors for recommendations.

Now, you have the resources to search for a pest control accountant who knows your business. Let’s have a look at how to choose the right one.

How Can I Choose the Right Pest Control Accountant?

Choosing the right accountant for your pest control business is a process that ensures the perfect fit.

Step 1: Start with Some Initial Screening

Review resumes and cover letters to check qualifications, experience and industry knowledge.

Look for experience with small businesses, especially in managing industry-specific challenges like seasonal cash flow and inventory management.

Look for someone who understands the financial needs of pest control technicians, including their median salary, business owner income and the cost of essential equipment and chemicals.

Check their proficiency in accounting software like QuickBooks, which is critical for pest control business finances.

Shortlist candidates with industry knowledge and understanding of pest control businesses' financial needs.

Step 2: Conduct Interviews

Schedule interviews to check communication skills, professionalism and overall fit with your business culture.

Ask specific questions about their experience with pest control companies and how they’ve handled industry challenges like regulatory compliance and seasonal fluctuations.

Check their knowledge of pest control business finances, including invoicing, bookkeeping and tax returns.

Can they clearly explain complex financials and provide proactive financial advice?

Step 3: Check Up on References

Contact references to verify past performance, reliability and professionalism.

Ask about their experience and how they managed industry-specific challenges.

Ask about their communication skills, punctuality and ability to meet deadlines.

Do they have a proven track record of helping similar businesses achieve financial stability and compliance?

Step 4: Conduct Background Checks

Consider background checks to ensure the accountant is trustworthy as they will handle sensitive financial information.

Verify their credentials and certifications, like CPA or CMA, to confirm their qualifications.

Check for any past legal issues or financial discrepancies that could be risky.

Make sure they have a clean record, which is important to maintain trust and protect your business finances.

Step 5: Compare Qualifications

Evaluate the qualifications and certifications of each candidate, focusing on those relevant to the pest control industry.

Look for experience managing pest control company finances, including industry-specific challenges like seasonal revenue.

Check for additional skills like QuickBooks or other accounting software to make them more effective.

Check their overall fit with your business needs. Do they have the expertise to manage your pest control business finances?

Step 6: Consider Fees

Compare each candidate's fee pricing, payment structures, hourly rates, retainers, or project-based fees.

Which structure fits your business's financial situation and cash flow management needs?

What value do they bring to your business, expertise, efficiency and cost savings?

Are the fees reasonable for the services provided without compromising the financial management your pest control business needs?

Step 7: Trust Your Gut

After all the above, trust your gut when making the final decision.

Choose the accountant who has the right qualifications and experience and feels right for your pest control business.

How do you feel about their communication style, problem-solving approach and overall vibe?

Remember, a good partnership with your accountant is crucial to your pest control business's long-term financial health and success.

Now, let’s look at how to conduct a successful interview.

What Questions Should I Ask During an Interview with a Potential Pest Control Accountant?

Asking the right questions during an interview with a potential pest control accountant can help determine if they have the expertise and experience to manage your business's unique financial challenges.

1. How do you stay current on industry regulations and tax laws concerning pest issues?

Look for proof of ongoing professional development and a commitment to staying current, which is important for compliance and tax benefits.

2. How have you helped other pest control businesses manage seasonal revenue fluctuations?

This question tests their experience with the pest control industry and their ability to manage cash flow throughout the year.

3. What accounting software are you most proficient in, and how would you integrate it with our existing systems?

Make sure they are proficient in QuickBooks and can integrate with your existing systems to improve financial management.

4. How do you approach inventory management for a pest control business?

Check their understanding of the complexities of inventory tracking and managing chemicals and equipment, which is critical to your business. Inventory management for common pest issues is important to ensure effective pest control services, as it allows for timely and efficient solutions to protect homeowners from pest problems.

5. Can you describe a time when you identified and resolved a significant financial issue for a client?

This question tests their problem-solving skills and ability to proactively address financial issues before they become big problems, such as problems with their company credit card or bank account.

6. How do you ensure your clients comply with all relevant financial reporting requirements?

Look for a systematic approach to compliance, which is important to avoid legal issues and protect your business’s financial health.

By asking these questions, you can hire the right candidate for your pest control business.

How Can FieldRoutes Streamline Financial Management for Pest Control?

FieldRoutes is a pest control-specific software that offers many tools to streamline operations and financial management.

Invoicing and Payments: FieldRoutes auto invoices and pays your pest control business on time with minimal effort. This simplifies cash flow management and reduces errors.

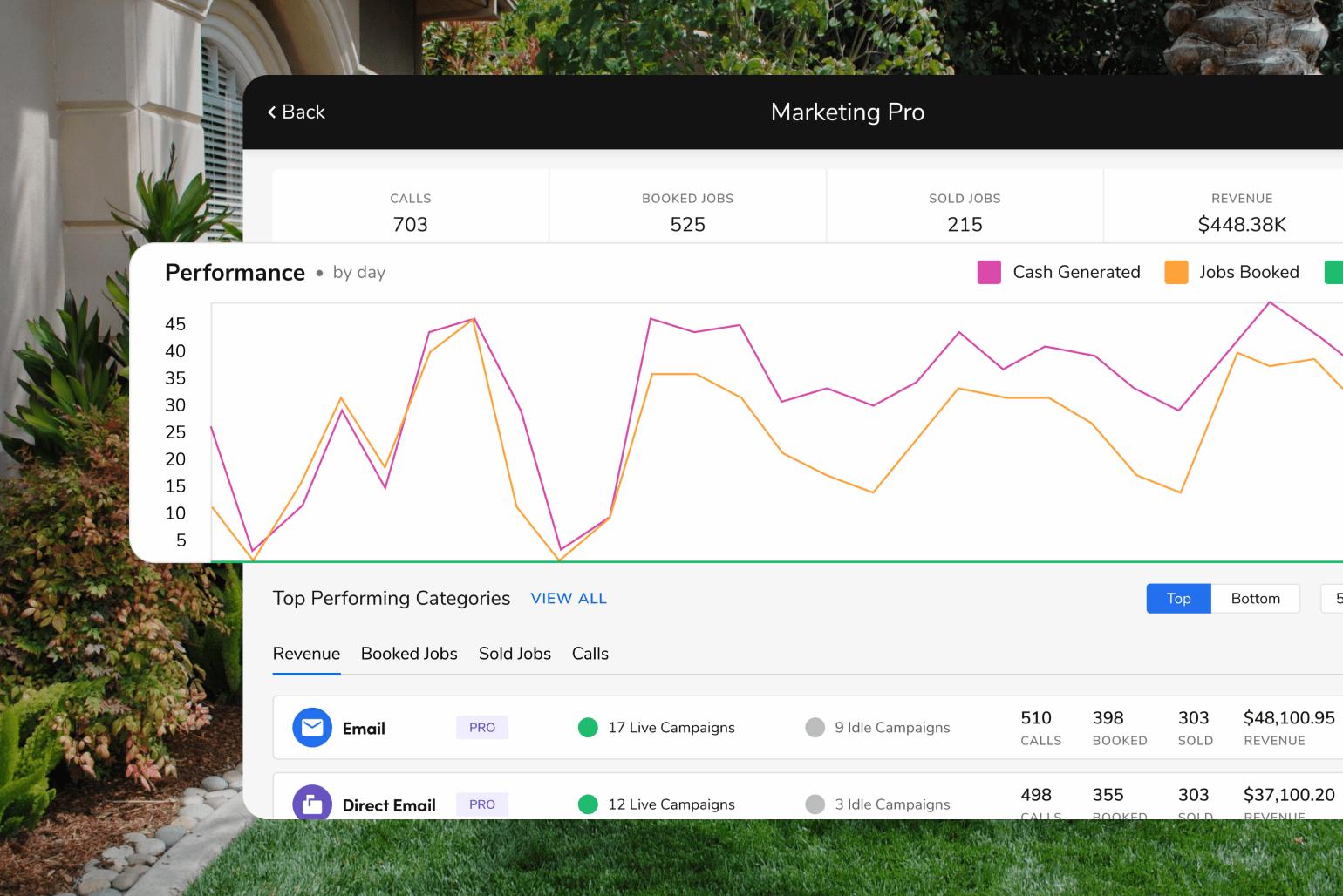

Reporting: With FieldRoutes, you can generate detailed financial reports to assess your business's health. These reports are important for decision-making and compliance.

Seamless Integration: FieldRoutes integrates with popular accounting software like QuickBooks to transfer and sync data easily, keeping your financial data current.

Clean Data: FieldRoutes automatically tracks and organizes financial data, so you don’t have to. This reduces human error and saves time for you and your accountant.

Real-Time Insights: Accountants can access up-to-date financial information through FieldRoutes to analyze and make real-time decisions to support your business growth.

Increased Efficiency: By automating routine tasks, FieldRoutes frees up your accountant’s time so they can focus on higher-level financial strategy and consulting.

FieldRoutes can also help schedule and track pest control treatments to improve operational efficiency. These features simplify financial management and strengthen your relationship with your accountant, allowing your pest control business to grow in the long term.

It’s Your Turn Now

Hiring a pest control accountant is crucial for managing the financial complexities of your business.

Follow the steps in this guide, and you’ll find the right accountant to manage your financial health, stay compliant and support your business growth. Long-term benefits include better cash flow, smarter decision-making and a stronger financial base.

Schedule a free demo of the FieldRoutes Operations Suite today and discover how we can streamline your financial management.