How to Buy a Pest Control Company (Step by Step)

Whether you plan to expand existing operations or enter the pest control industry via acquisition, buying a pest control business requires thorough due diligence and industry knowledge. Buyers must understand the business's fair market value and any industry-specific legal and regulatory requirements.

This article outlines the acquisition process, with steps for:

Evaluating potential targets

Conducting due diligence

Negotiating deals

Overcoming common challenges

1. Determine your goals and criteria for the acquisition

Consider why you want to acquire a company. While acquisitions bring many benefits, like an established customer base and reliable cash flow, they may not always provide the most effective path forward for an existing or new pest control business owner.

Consider the following:

Budget for both the purchase and ongoing operational costs

Market positioning and growth opportunities

Risk tolerance levels

Needs and preferences (location, size, services offered)

Planning for these factors enables pest management entrepreneurs to find a business that aligns with their goals and maximizes their investment.

2. Identify potential target companies

Identify target companies that match your criteria. Hire a business broker to help find pest control companies for sale, or search via:

Online databases: Websites like BizBuySell and BizQuest allow you to search acquisition opportunities by market and industry. These databases provide detailed business information, including financial performance and service offerings.

Trade publications: Industry-specific publications and websites advertise businesses for sale within the pest control industry.

Industry events: Attend industry events to build your network and learn about opportunities that may not even be listed yet.

Networking: Utilize your existing industry contacts to see if they know of pest control operators open to selling. Referrals get you in the door before the competition heats up.

Once you identify targets, research their location, market demand, competition, and growth potential to determine whether they’re the right fit.

3. Draft and sign the required documents for the start of the acquisition process

Initiating the acquisition process involves preparing and signing key documents. These documents set the foundation for negotiations and ensure both parties are aligned on the acquisition terms. These documents include:

Letter of intent (LOI): Before a company opens its books, you must submit a signed LOI to be allowed to conduct due diligence. Also called a term sheet, the LOI is a non-binding document in which a buyer outlines the basic terms and conditions of the proposed acquisition.

Nondisclosure agreement: To protect sensitive information shared during the negotiation process, the buyer and seller typically sign NDAs, which mandate not disclosing or using proprietary information for any purpose other than evaluating the potential acquisition.

Ensure all documents are written in clear, precise language to avoid misunderstandings. Seek legal review to protect your interests and ensure compliance with relevant laws.

4. Perform comprehensive due diligence on the target company

Conduct merger and acquisition (M&A) due diligence, which involves financial, operational, legal, and regulatory scrutiny of the company. Engage accountants, lawyers, and industry experts to provide insight and ensure thorough analysis. You can also utilize a due diligence checklist or software program.

Due diligence covers:

Financial: Examine financial records, including tax returns, balance sheets, and cash flow statements, to assess the accuracy of reported revenues and expenses and identify any financial risks or liabilities.

Operational: Evaluate the company's day-to-day operations, including its management structure, employee performance, and customer satisfaction. Analyze operational efficiencies and identify areas for improvement.

Legal: Review all legal documents, including business insurance, contracts, and pest control licenses. Ensure the company complies with all relevant laws and regulations and identify any ongoing or potential legal issues.

Regulatory: Verify the company adheres to industry-specific regulations and standards, such as compliance with termite reporting requirements or holding the appropriate pesticide applicator license.

5. Negotiate the terms of the acquisition

When entering negotiations, know your desired outcome, where you’re willing to negotiate, and at what point you plan to walk away. Both the buyer and seller need to reach an agreement on the following key elements:

Price: Establish a fair purchase price based on your due diligence findings and market value. Justify your offer with solid data and remain open to counteroffers.

Payment terms: Decide on the payment structure, including upfront payment, installments, or earn-outs based on future performance. Ensure the terms are feasible for both parties.

Warranties: Negotiate warranties to protect against potential misrepresentations or undisclosed liabilities. This may include guarantees about the company's financial health, legal standing, and operational performance.

Contingencies: Outline any conditions that must be met for the deal to proceed, such as securing financing, obtaining regulatory approvals, or resolving specific issues identified during due diligence.

Tailor the deal structure to align with the seller’s needs for a smoother negotiation.

6. Draft and finalize the purchase agreement

Draft and finalize a purchase agreement, which is a binding document that outlines the terms and conditions of the acquisition. Many websites offer purchase agreement templates. Hiring an M&A lawyer to draft the agreement ensures the document is legally sound and protects your interests.

The purchase agreement should include:

Purchase price

Payment terms

Representations and warranties

Closing conditions

Dispute resolution procedures

Both parties will thoroughly review the draft agreement and provide feedback. It may take multiple drafts before the purchase agreement is ready for signing. Throughout this process, ensure all terms are clear and agreed upon to prevent future misunderstandings.

Key Factors to Consider When Evaluating a Pest Control Business for Acquisition

Consider the following when selecting an acquisition target.

Financial performance

Key financial indicators and metrics provide insight into the business’s financial health and growth potential. A comprehensive financial review includes:

Perform ratio analysis by analyzing financial statements, including income statements, balance sheets, and cash flow statements.

Examine revenue trends to identify growth patterns and seasonal fluctuations.

Analyze profit margins for each service and product offering and as a blended average.

Review assets and liabilities to determine the company’s financial stability.

Assess the company’s market position and predict growth by comparing it to industry benchmarks, peers, and competitors.

Customer base

A strong and loyal customer base alludes to steady revenue and growth opportunities for a pest control business. To analyze a company’s customer base, consider:

Residential vs. commercial client mix

Geographic distribution

Service frequency

Duration of customer relationships

A pest control company typically stores and maintains this information in a customer relationship management (CRM) database.

Understanding customer needs, preferences, and expectations is essential for identifying growth opportunities. Review existing contracts to understand the terms, pricing structures, and revenue predictability.

Conduct surveys, gather feedback, and analyze customer data to gain insights into what customers value most. Identify potential risks, too, such as reliance on a few major clients and low retention rates. Addressing risks and leveraging growth opportunities builds a stable, expanding customer base.

Reputation and brand

A pest control business's reputation and brand significantly impact its market position and customer trust. These elements provide valuable insight into the company’s standing and long-term success potential.

Conduct a comprehensive brand audit by evaluating brand awareness, market positioning, and the consistency of the company's messaging and identity. Review online feedback and reviews on platforms such as Google, Yelp, and industry-specific sites.

Monitor social media mentions and discussions to analyze market sentiment and understand how the broader community perceives the brand.

Ask customers, employees, and partners for their feedback in one-on-one meetings or anonymous surveys. This qualitative data uncovers strengths and weaknesses you won’t find in online reviews.

Service offerings

Review each pest control service offering to understand its effectiveness, profitability, and customer satisfaction levels. Identify any unique or innovative services, such as bed bug fumigation or lawn care services, that differentiate the business from competitors.

Consider the methods and products used in treatments and whether they align with industry standards and best practices. Decide whether you want to tweak service offering methods or scale back non-revenue-generating endeavors.

Evaluate customer demand for inspection, treatment, prevention, and maintenance offerings, looking for gaps to introduce new products and services. A comprehensive service portfolio attracts more business from homeowners and commercial clients.

Regulatory compliance

Pest control businesses must adhere to regulatory requirements and standards, which vary by state and locality. Buyers must ensure the acquisition target carries the appropriate business and pesticide applicator licensing and complies with all applicable standards

Evaluate the company’s compliance management system, which shows its commitment and ongoing adherence to regulatory compliance. Effective systems include regular employee training, clear protocols for regulatory adherence, and routine internal audits.

Employee skills and training

Assessing employee skills, qualifications, and experience levels is crucial for evaluating the target company's operational capabilities. Evaluate workforce skills in pest identification, treatment techniques, safety practices, and customer service.

Assess employee retention rates to gauge morale and experience—issue employee surveys to identify areas for improvement. Read online reviews and look for pest control technicians who are mentioned by name to uncover improvement opportunities.

Based on feedback, consider offering workshops or sending key personnel to continuing education courses.

Technology and infrastructure

Review the company's infrastructure, including facilities, vehicles, and equipment, to ensure these resources are well-maintained and sufficient to meet operational demands.

Evaluate the company’s existing tools and technology, such as monitoring devices, treatment equipment, and business software. Consider abandoning any redundant systems or equipment or upgrading to improve efficiency.

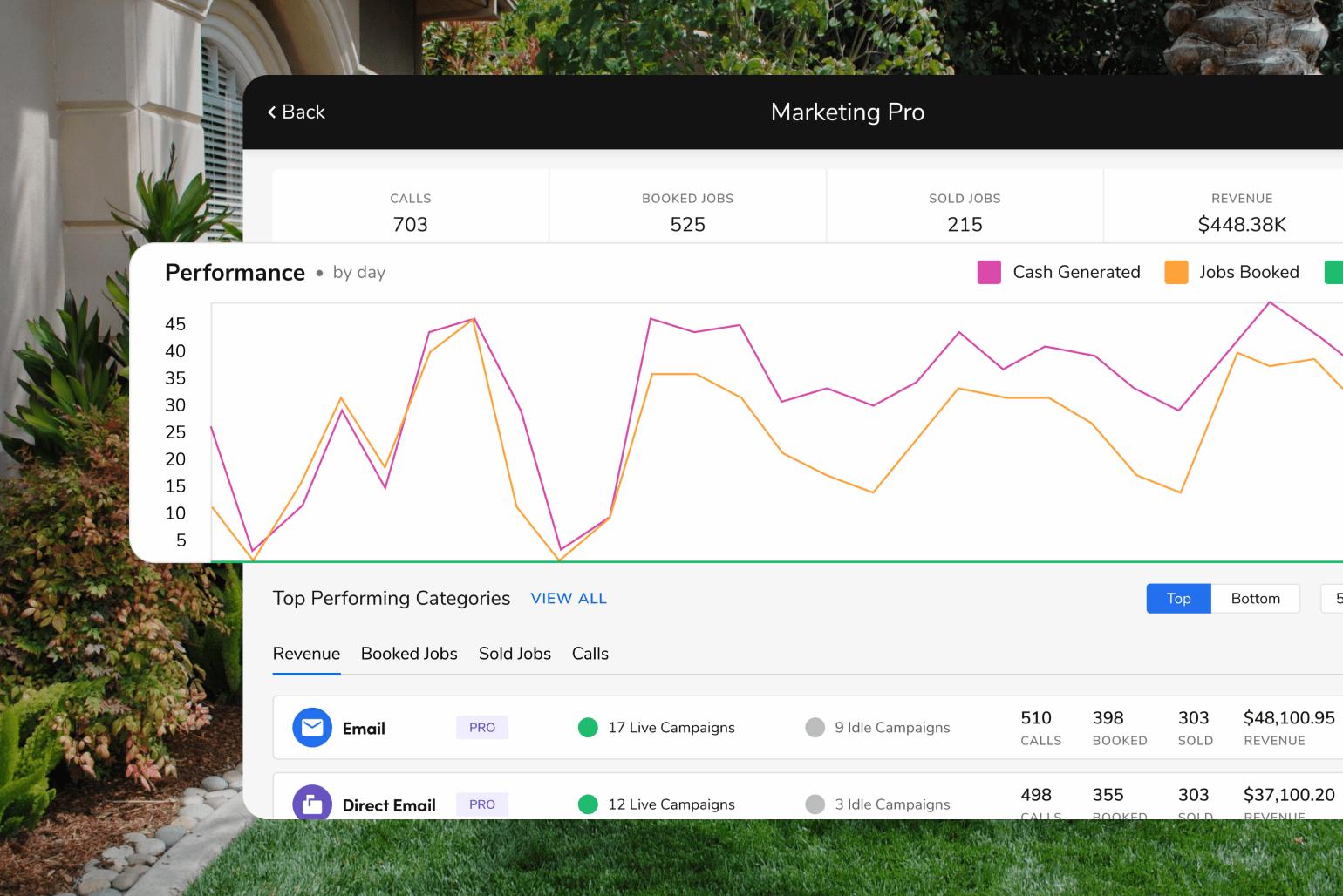

Adopting innovative pest control technology, like FieldRoutes pest control software, streamlines operations, enhances service delivery, and provides a competitive edge in the market.

Questions to Ask When Purchasing a Pest Control Business

Ask the following questions when evaluating a pest control business for acquisition.

Financial

What is the company's annual revenue and profit margin?

Can you provide detailed financial statements for the past three years?

Are there any outstanding debts or liabilities?

What is the breakdown of revenue by service offering and customer segment?

What are the company's pricing strategies, and how do they compare to competitors?

Operational

What is the size and composition of the customer base?

What is the average customer retention rate?

What technology and equipment does the company use?

How are employees trained and managed?

What is the current state of the company's infrastructure?

Regulatory

Are all necessary licenses and permits up to date?

How does the company ensure compliance with environmental and safety regulations?

Have there been any regulatory violations in the past, and if so, how were they resolved?

What measures are in place to stay up-to-date with changing regulations?

Strategic

What are the growth opportunities for the business?

Are there any potential risks or challenges facing the business?

How high are the company's brand reputation and customer satisfaction levels?

What is the owner's reason for selling?

The answers to these questions offer a comprehensive understanding of the pest control business.

Common Challenges to Avoid During the Acquisition Process

To ensure a successful acquisition, avoid these common mistakes:

Valuation discrepancies: Verify that the asking price reflects the company’s actual value and is based on a reliable business valuation method, such as SDE multiples, REV multiples, or EBITDA multiples.

Regulatory hurdles: Ensure all necessary licenses and permits are in place, and the company complies with environmental, health, and safety regulations. Failure to meet these requirements results in legal issues and fines.

Integration issues: Merging operations, systems, and processes can be challenging. Develop a detailed integration plan to address these complexities, including technology integration, workflow alignment, and employee training.

Cultural differences: Assess the organizational cultures of the merging companies and identify potential clashes. Foster open communication and involve employees in the integration process to create a unified and collaborative work environment.

To navigate these challenges, understand the operational challenges specific to the pest control industry, such as staffing issues, customer retention, and environmental regulations, and develop a business plan to address them. Consult legal, financial, and industry experts, especially those well-versed in acquisitions, to guide you through the process.

Learn More About Growing Your Pest Control Business

Acquiring a pest control business provides an opportunity to break into the home services industry with a reliable customer base and cash flow or scale existing operations. To streamline operations and supercharge growth, invest in an end-to-end business management software solution purpose-built for the pest control industry.

FieldRoutes pest control software empowers pest control companies to simplify, scale, and grow through advanced features for scheduling, routing, payment collection, pest control marketing, reporting, and more. Check out the FieldRoutes Resource Hub for more information on running a successful pest control business.

Frequently Asked Questions (FAQs)

Common questions regarding buying and selling pest control companies include: Q1. Is a pest control business profitable?

According to FinModelsLab, a leading provider of financial tools and resources for startups and small businesses, the average profit margin for pest control companies in the U.S. ranges from 10% to 20%. Learn how to calculate and maximize pest control profit margins.

Q2. Are pest control franchises profitable?

Profitability depends on factors like location, market demand, operational efficiency, and effective marketing. In general, pest control franchises are profitable endeavors with a low entry cost.

Franchisees benefit from established brand recognition, proven business models, and ongoing support from the franchisor.

Q3. How much is my pest control company worth?

The value of your pest control company depends on several factors, including revenue, profit margins, customer base, and market conditions. Common valuation methods include using SDE multiples, revenue multiples, or EBITDA multiples. Consult a professional business appraiser for an accurate valuation.