Finding the Right Collections Agency for Your Pest Control Business

Unpaid invoices can hurt a pest control business, as well as its cash flow and operational efficiency.

Managing your aging accounts is vital to keeping your business profitable. One option is working with a collections agency that understands the pest control industry, can recover debt, and preserve customer relationships.

This guide will show you how to choose the right collections agency and how FieldRoutes’ software can reduce the need for external help with automated invoicing and payment solutions.

Why Do Pest Control Businesses Need a Specialized Collections Agency?

Pest control businesses have unique challenges that can impact cash flow and operational efficiency.

Seasonality is a big one, with fluctuating demand resulting in inconsistent revenue streams. Although maintaining customer relationships is vital in a service-based industry, unpaid invoices, and defaulters can damage those relationships. Invoicing issues like delayed payments or non-follow-up can further strain and challenge small businesses.

Working with a collections agency that understands the pest control industry has several benefits:

Better Cash Flow: Agencies specializing in pest control debt collection can return payments faster, keeping your business healthy and growing.

Less Administrative Hassle: Outsource debt collection to experts who handle everything from start to finish.

Customer Retention: Specialized agencies use a gentle approach to preserve customer relationships during recovery.

Working with the right agency will get collections done while keeping customer interactions positive.

What Questions Should You Ask a Collections Agency?

Choosing a pest control collections service for your business is critical to recovering past-due accounts and preserving customer relationships. Ask the right questions to find an agency that fits your needs and understands the pest control industry.

By asking these questions, you’ll ensure that the collections agency you choose fits your pest control business.

Now, let’s get to the key factors to consider when deciding.

Is the 3rd party collection agency familiar with the pest control industry?

Frequently, collection agencies find themselves assisting businesses in a specific niche. As with any business, there are nuances to collections, and you want to go with a company that understands what you do, what your billing process looks like, what the industry averages are, and more.

When interviewing an agency, ask what other clients they have worked with within your industry, if they have any case studies around those clients, or if they have a client willing to share their experience with you.

Also, asking what kind of results they see within your industry is key to determining whether they truly know what they are talking about and to giving you an idea of what to expect when handing over your aging accounts.

What methods does the agency use to secure past-due payments?

Hiring an agency that understands the value of repeat customers is imperative for keeping customers during and after the collection process.

When learning more about different agencies you are considering for hire, ask them what systems they have in place to put diplomacy first in the collection process.

For example, our industry partner, A.R.M. Solutions, uses the term “diplomatic approach to collections” in its tagline. Ask what that looks like, why it is important, and what results they see by adhering to it.

What fees do they charge?

Every agency has a different pricing strategy, so it's also really important to understand the cost of the collection agencies’ services.

Take a few of your agency accounts as an example, and ask the rep from the agency to explain how much you would collect if they were to collect on an account in a certain amount of time. Also, ask if they offer any other “non-standard” collection programs (like A.R.M. Solutions’ Flat-Fee Program) that could save you even more money!

What is the process for passing over aging accounts?

It is key to hire an agency that understands that you are busy and wants to alleviate any additional work on aging accounts.

Ask the agencies you are interviewing about the process when passing along aging accounts. Do they have a portal for uploading and tracking?

Do you have a point person within the agency you can contact for reports, updates, and any questions that may arise through the process?

Make sure that they intend to value your time and your employees’ time by understanding the process and ensuring that your convenience and ease are the most crucial parts.

By asking these essential questions, you can ensure the collections agency you choose aligns with your pest control business needs. Next, let’s explore the key factors to consider when making your final decision.

What Are the Key Factors to Consider When Choosing a Collections Agency?

Choosing the right collections agency is vital for pest control business owners to get paid on outstanding invoices while keeping customer relationships strong. To make an informed choice, look at these:

Experience in the pest control industry. Partner with a debt collection agency that knows the pest control industry. Agencies that know your sector can manage accounts receivable, implement specific recovery strategies, and improve your cash flow. Ask for case studies or references from other pest control businesses to prove their expertise.

Transparency in fees and services. Know the pricing structure of a debt collection agency. Some agencies charge contingency fees, others flat-fee programs. Ask for a breakdown of costs to avoid surprises and see if their services fit your budget.

The success rate in recovering payments. An agency’s success rate is a good indicator of its effectiveness. Ask for data on past recoveries, especially in the pest control industry. Agencies with proven methods like skip tracing, collection letters, and follow-up calls will get better results.

Communication process with your team and customers. Clear communication is key to debt recovery. Choose an agency that provides:

A dedicated point of contact for your team

Progress updates

Diplomatic communication methods to preserve customer relationships

Compliance with debt collection regulations. Ensure the agency complies with laws like the Fair Debt Collection Practices Act (FDCPA) to protect your business from legal risks. Agencies with expertise in compliance won’t use aggressive tactics that can harm your reputation.

Now that you’ve covered that let’s look at the methods collections agencies use to get paid.

What Are the Methods Used by Collections Agencies to Recover Payments?

Any debt collection agency aims to collect unpaid invoices, but its methods impact recovery rates and customer relationships.

Effective recovery strategies balance persistence with diplomacy so debts are collected without alienating customers. For pest control businesses, this is especially important, as your reputation in the community can affect long-term success.

Collection agencies use various techniques, from collection letters and phone calls to advanced methods like skip tracing. Ethical and compliant practices—aligned with the Fair Debt Collection Practices Act (FDCPA)—are crucial to treating customers fairly and avoiding legal risks.

Now you know how to choose an agency that gets paid on past due accounts while keeping relationships and reputation intact.

Key Methods for Debt Recovery

Collection Letters and Notices Agencies start the recovery process by sending formal collection letters to customers to notify them of overdue payments. These letters clearly state the amount owed, deadlines, and consequences of non-payment.

Phone Calls and Follow-Ups Persistent but diplomatic phone calls are the backbone of the collection process. Agents trained in communication will negotiate payment terms or take credit card payments while being professional so the customer feels respected.

Skip Tracing Agencies use skip tracing to find customers who have changed contact details and phone numbers or moved. This method combines databases, credit reports, and public records to find defaulters.

Credit Reporting Agencies may report unpaid debts to credit bureaus, which can affect the customer’s credit score. This will motivate many defaulters to pay up quickly.

Legal Action Some agencies will take legal action as a last resort. However, ethical agencies with years of experience will always seek alternatives to avoid escalation and legal costs.

First-Party Collections Some agencies offer first-party collections where they act as an extension of your team under your business name to get paid more discreetly.

Tactful agencies will maintain customer relationships to protect your pest control company’s bottom line and reputation.

Now that you know how it all works, you can evaluate how collections agencies operate and make an informed decision for your pest control business.

How Can FieldRoutes Help Minimize the Need for Collections Agencies?

Unpaid invoices and bad debts can strain your pest control company, but FieldRoutes has a solution that automates invoicing, payment reminders, and customer account management.

By automating these processes, FieldRoutes ensures timely payments, so you don’t need to rely on third-party debt collection agencies. This proactive approach improves cash flow and preserves customer relationships, making the billing experience positive.

With FieldRoutes, payments are on time, so your team doesn’t have to chase debtors or third-party agencies.

FieldRoutes is designed for pest control businesses to tackle issues like delayed payments, missed follow-ups,s, and manual administrative tasks. It helps you manage accounts receivable while protecting customer relationships and your bottom line.

FieldRoutes Features to Streamline Collections

Automated Invoicing Automate and send invoices to reduce manual work and delays. Timely billing means customers get clear and accurate statements and will pay on time.

Payment Reminders FieldRoutes automates reminders via email or text to keep customers informed of upcoming due dates. These gentle nudges will improve payment rates and reduce overdue invoices.

Recurring Payments Allow customers to set up automatic recurring payments for regular services. This will make life easier for both parties and ensure consistent income.

Customer Account Management Centralized customer profiles to track payments and outstanding balances. Businesses can quickly identify overdue accounts and proactively address them before they require collection efforts.

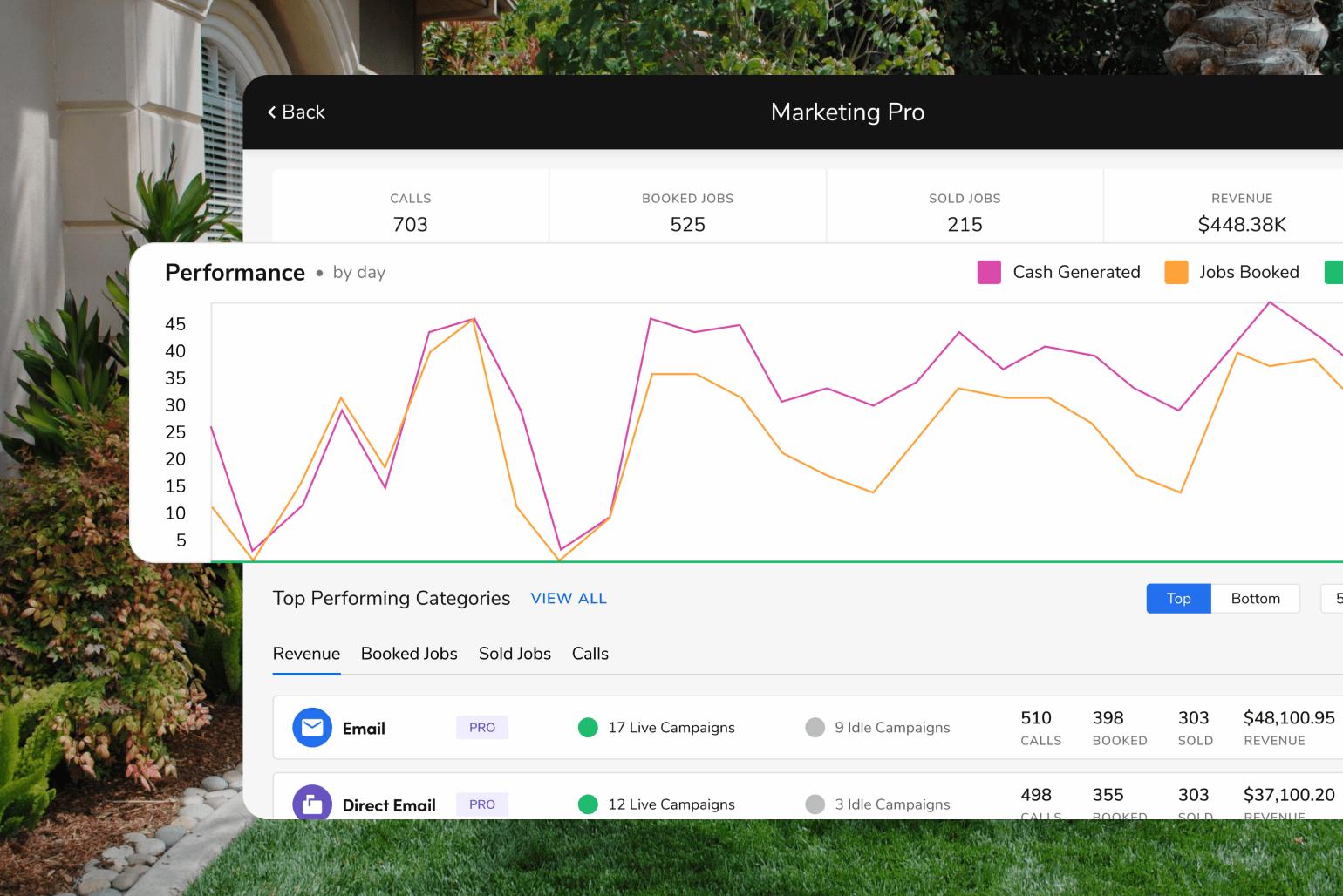

Reporting and Analytics See payment trends, overdue accounts, and cash flow. Use this data to adjust and reduce unpaid invoices and determine which needs contingency collection.

With FieldRoutes automation, you can address payment issues before they become problems. Invoicing on time, setting up recurring payments, and sending reminders mean customers pay on time, and the number of past-due accounts is reduced.

These tools also reduce the workload on your staff so they can focus on core business activities.

By automating the invoicing and payment collection parts of FieldRoutes, payments are received on time, so you don’t need to use expensive and time-consuming third-party debt collection services.

It’s Your Turn Now

Unpaid invoices don’t have to be a headache.

With a debt collector agency or FieldRoutes, your pest control business can stay on top of accounts receivable.

Ask the right questions to suit your debt collection needs and take control with automation tools that simplify your billing with FieldRoutes.

Schedule a free demo for FieldRoutes Operations Suite today.