Budgeting for Pest Control Businesses (Effectively Manage Your Finances)

Running a pest control business requires more than just providing quality service—it demands smart financial management.

Without a structured budget, pest management business owners may struggle with cash flow, rising operating costs, and inconsistent revenue.

A well-planned budget helps pest control companies:

Reduce unnecessary expenses and optimize spending.

Improve cash flow by managing revenue and costs efficiently.

Increase profitability by allocating resources effectively.

Achieve all their business goals to grow their service business.

Every dollar should be accounted for, from managing start-up costs to handling daily operating expenses. A clear budget ensures stability, supports business growth, and prepares companies for unexpected expenses like equipment repairs or seasonal slowdowns.

This guide will give you the know-how on seven essential budgeting steps, helping you make informed financial decisions, avoid common pitfalls, and streamline your financial processes.

Whether you're a pest control start-up or an established company, these strategies will help you stay profitable and scale effectively.

Let’s dive into the first step—assessing your current financial situation.

Step 1: Assess Your Current Financial Situation

Before creating a budget for your pest control business, you need to understand where your finances currently stand.

A clear financial snapshot helps small business owners make informed decisions, eliminate wasteful spending, and allocate resources effectively.

Start by analyzing income, expenses, and profits as part of your business plan.

Reviewing past financial records provides insight into operating costs, cash flow trends, and areas that need adjustment. Without this step, you risk underestimating expenses or setting unrealistic revenue goals.

A cash flow analysis helps identify potential issues before they affect your business. If you’re experiencing inconsistent cash flow, pinpoint when income fluctuates and adjust your budget accordingly.

This is especially important for businesses affected by seasonal pest problems, such as termite swarms in the spring or increased bed bug treatments in the summer. Additionally, plan for any additional costs that might arise from unexpected pest issues.

Once you understand your financial position, you can create a realistic budget that supports business growth and long-term sustainability.

Next, let’s break down how to identify fixed and variable costs.

Step 2: Identify Fixed and Variable Costs

A pest control business has two types of expenses: fixed costs and variable costs.

Understanding the difference helps you optimize spending, plan for fluctuations, and maintain a healthy profit margin.

Fixed Costs: The Predictable Expenses

These costs stay the same regardless of how many pest control services you provide. They help keep your business running, even during slow seasons. Budgeting for standard treatment protocols ensures consistent service quality.

Typical fixed costs for pest control companies include:

Rent or mortgage – Office space or storage for equipment and sprayers.

Insurance – General liability, worker’s compensation, and vehicle coverage.

Employee salaries – Payroll for full-time staff, including technicians and administrative teams.

Software subscriptions – CRM tools like FieldRoutes and QuickBooks for accounting and scheduling platforms.

Since these expenses don’t change often, they should be budgeted first to ensure stability.

Variable Costs: The Fluctuating Expenses

Variable costs depend on service volume, seasonal demand, and business growth. Pest control treatment costs can vary based on the type and frequency of services provided.

Common variable costs include:

Fuel expenses – Travel costs fluctuate, especially for businesses covering large service areas.

Equipment maintenance – Repairs or replacement of sprayers, bait stations, and insecticide application tools.

Seasonal labor – Hiring extra technicians during peak infestation periods.

Marketing campaigns—Invest in a pest control marketing plan that includes Search Engine Optimization (SEO), social media, and paid ads to reach potential customers in your target market.

By tracking these expenses, business owners can adjust their marketing efforts based on demand and optimize their budget.

Next, let’s set realistic revenue goals to ensure long-term profitability.

Step 3: Set Realistic Revenue Goals

Setting realistic revenue goals helps pest control businesses stay profitable and grow sustainably. Without clear targets, it’s easy to overspend or miscalculate potential earnings.

Business owners can create achievable financial benchmarks by analyzing past performance and adjusting for seasonal fluctuations.

Analyze Past Performance

Review past revenue reports to identify income trends. Look at:

Average monthly income – Identify high and low revenue periods.

Service demand – Determine which pest control services bring in the most profit.

Customer base growth – Track how many new customers you acquire each quarter.

If revenue has been inconsistent, pinpoint what caused the fluctuations. For example, was there a drop due to a lack of pest control marketing, or did average costs increase unexpectedly?

Factor in Seasonal Fluctuations

The pest control industry experiences seasonal trends that affect revenue. Addressing common pests like ants, spiders, and roaches can help manage seasonal demand effectively.

Spring and summer – Increased demand for termite treatments, insecticide applications, and bed bug extermination.

Fall and winter – Slower periods requiring a stronger focus on customer retention and recurring contracts.

Budgeting for these fluctuations ensures you have enough cash flow to cover fixed costs during slow months.

Use Benchmarks to Set Goals

Set realistic revenue targets based on:

Historical sales data

Local market trends

Competitive pricing strategies

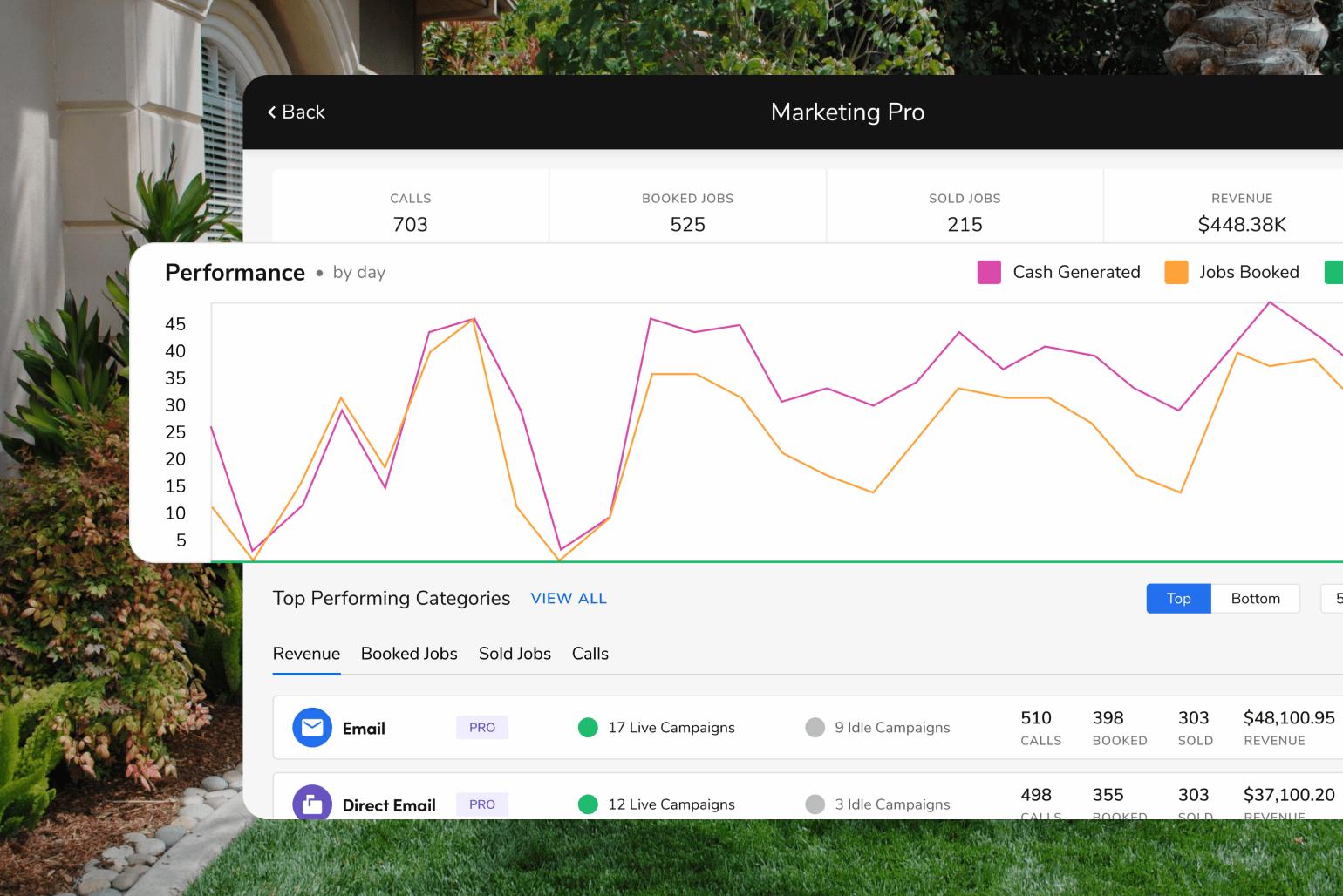

Use pest control software like FieldRoutes to track real-time financial metrics and streamline revenue forecasting.

Next, allocate your budget across key business areas for maximum efficiency.

Step 4: Allocate Your Budget Across Key Areas

Once you’ve assessed your financial standing and set realistic revenue goals, it’s time to allocate your budget efficiently.

Prioritizing high-return investments helps your pest control business grow while maintaining operational efficiency.

Labor and Payroll

Your technicians and staff are the backbone of your pest control services. Budgeting for:

Full-time salaries for technicians, office staff, and sales teams.

Seasonal labor costs to handle peak infestation periods.

Certifications and training to ensure compliance and improve customer satisfaction.

Having the same technician for regular clients to ensure consistent service quality and customer trust.

Balancing labor costs with revenue ensures you can scale without overextending your payroll.

Equipment and Supplies

Investing in the right tools boosts service quality and efficiency. Allocate funds for:

Equipment maintenance – Routine servicing for sprayers, traps, and application tools.

New purchases – Upgrading to eco-friendly pesticides or termite bait stations.

Safety gear: Masks, gloves, and protective equipment for technicians. We are investing in specialized equipment for termite control to enhance service offerings.

Well-maintained equipment reduces unexpected costs and enhances business operations.

Marketing and Customer Acquisition

A strong pest control marketing strategy attracts new customers and strengthens your online presence. Budget for:

SEO and website optimization – Improve search rankings for pest control website visibility.

Social media marketing – Engage local homeowners and businesses.

Referral programs – Encourage word-of-mouth recommendations from satisfied clients.

Investing in marketing strategies helps expand your customer base and drive long-term revenue.

Fuel and Transportation

Efficient routing minimizes travel costs and maximizes technician productivity. Allocate funds for:

Fuel costs – Rising gas prices impact operating expenses.

Vehicle maintenance – Regular servicing prevents breakdowns.

Route optimization software – Tools like FieldRoutes help reduce unnecessary miles.

A well-planned transportation budget ensures cost-effective service delivery across your service area.

Next, let’s explore how to plan for emergencies and unexpected expenses.

Step 5: Plan for Emergencies and Unexpected Expenses

If you don't plan, unexpected costs can disrupt your pest control business. Equipment failures, slow seasons, or rising operating expenses can impact cash flow and profit margins.

A well-prepared emergency fund ensures financial stability without affecting daily operations.

Why an Emergency Fund Matters

A pest control business faces unpredictable expenses, such as:

Equipment breakdowns – Sprayers, baits, and traps wear out over time or, at times, suddenly stop working.

Vehicle repairs – Service trucks and vans need maintenance, especially with high fuel consumption.

Seasonal slowdowns – Demand for types of pest control drops during colder months, affecting customer base and revenue.

Unexpected costs – Regulatory compliance updates, certifications, or business operations changes.

Business owners may struggle to cover costs without a backup fund, leading to financial strain.

How to Build an Emergency Buffer

Set aside 5-10% of monthly revenue into a separate account.

Cut unnecessary expenses – Optimize marketing strategies by focusing on SEO and referral programs instead of high-cost ads.

Financial software like QuickBooks or FieldRoutes can be used to track spending in real time.

Negotiate supplier contracts to secure better pricing for pesticides, insecticides, and fuel.

A safety net helps maintain operational efficiency and protects your business from unexpected setbacks.

Next, explore how to monitor and adjust your budget for long-term success.

Step 6: Monitor and Adjust Your Budget Regularly

A budget is not a one-time plan—it’s a living document that needs regular updates.

Pest control business owners must track expenses and revenue to stay profitable and make informed financial decisions. Without consistent monitoring, hidden costs can add up, affecting profit margins and cash flow.

Why Regular Budget Reviews Matter

Reviewing your pest control business budget helps you:

Track spending trends – Identify where most of your revenue is going.

Detect financial inefficiencies – Reduce wasteful spending on underperforming marketing strategies or unnecessary supplies.

Improve forecasting – Adjust pricing and spending based on seasonal demand.

A monthly or quarterly budget review keeps your business financially stable and optimizes operational efficiency.

Best Tools for Budget Monitoring

Using financial software simplifies tracking and analysis. Consider:

QuickBooks – Automates invoicing, tracks expenses, and generates financial reports.

FieldRoutes – Helps pest control companies streamline payments, cash flow, and financial planning.

CRM systems – Track customer reviews, retention, and revenue performance.

How to Identify Areas for Cost-Cutting and Growth

Analyze return on investment (ROI) – Cut spending on low-performing pest control marketing campaigns.

Negotiate better deals – Lower operating costs by securing bulk pricing for pesticides and equipment.

Reinvest wisely – Allocate more to customer satisfaction initiatives, like follow-ups and loyalty programs.

Regular budget reviews help business owners maintain stability and improve long-term business growth.

Next, let’s explore how technology can streamline financial management for your pest control business.

Step 7: Use Technology to Streamline Financial Management

Managing finances manually can lead to errors, missed payments, and inefficient spending. Pest control business owners can simplify budgeting, track expenses in real time, and improve profit margins by leveraging technology.

The right pest control software can help businesses optimize costs, improve cash flow, and allocate resources efficiently.

Automate Invoicing and Expense Tracking

Using automated invoicing software eliminates the hassle of manual billing.

Key benefits include:

QuickBooks – Automates invoicing, categorizes operating expenses, and integrates with credit card payment systems.

FieldRoutes – Streamlines pest control services by managing payments, customer reviews, and real-time financial reporting.

CRM software – Tracks customer retention and automates follow-up processes for better cash flow management.

With automated financial tracking, businesses reduce errors and stay on budget effortlessly.

Use Route Optimization to Reduce Costs

Fuel is one of the most significant variable costs for pest control companies. Route optimization tools help reduce inefficient routes, thus reducing wasted fuel:

Reduce fuel consumption by planning the most efficient routes.

Increase technician productivity by minimizing travel time between service locations.

Lower operating costs while maintaining top-tier customer satisfaction.

Software solutions like FieldRoutes integrate route planning with financial tracking, helping businesses control fuel expenses and improve operational efficiency.

Leveraging technology simplifies financial management, improves budgeting accuracy, and supports business growth.

Next, let’s explore how FieldRoutes can simplify your pest control budgeting process.

How Can FieldRoutes Simplify Your Pest Control Budgeting?

Pest control business owners must efficiently manage their finances. FieldRoutes provides automated solutions to streamline invoicing, expense tracking, and financial planning.

With real-time insights and smart optimization tools, businesses can reduce operating costs, improve cash flow, and increase profitability.

Automate Invoicing and Payments

Manual invoicing can lead to errors, missed payments, and inconsistent cash flow. FieldRoutes automates billing to ensure pest control companies get paid on time.

Generate invoices automatically after service completion.

Track customer payments and send reminders for overdue balances.

Accept multiple payment options, including credit cards, to improve customer satisfaction.

Automated payment tracking allows businesses to maintain steady revenue without chasing unpaid invoices.

Track Expenses in Real-Time

Without precise expense tracking, it’s easy to lose sight of where money goes. FieldRoutes provides real-time insights into operating expenses, helping businesses optimize budgets.

Monitor spending on equipment, fuel, and labor.

Analyze financial reports to identify areas for cost-cutting.

Improve decision-making with data-driven insights.

By tracking expenses, business owners can ensure their pest control services remain profitable. Real-time tracking helps ensure that home pest issues are addressed promptly and effectively.

Optimize Routes to Cut Costs

Pest control companies incur significant expenses in fuel and labor. FieldRoutes’ route optimization tools help businesses reduce fuel consumption and increase operational efficiency.

Plan the most efficient routes for technicians.

Minimize fuel costs and travel time.

Complete more service calls per day to boost revenue.

Optimized service area coverage leads to higher profit margins and lower operating costs.

Improve Financial Planning

Budgeting requires accurate financial forecasting. FieldRoutes helps businesses refine revenue projections and manage expenses effectively.

Use historical data to project seasonal revenue fluctuations.

Adjust budgets dynamically based on customer base growth.

Identify profitable services to allocate funds efficiently.

By leveraging real-time financial data, businesses can make smarter budget decisions.

Next, let’s wrap up with key takeaways and how you can take action today.

It’s Your Turn Now

A well-planned budget keeps your pest control business profitable and running smoothly. By assessing finances, managing operating costs, and using the right tools, you can optimize cash flow and prepare for growth.

Track fixed and variable expenses to control spending.

Set realistic revenue goals based on past performance.

Invest in marketing strategies to attract new customers.

Use FieldRoutes to automate invoicing, monitor real-time expenses, and streamline operations.

Smart budgeting helps you stay competitive in the pest control industry. Learn more about setting profitable pricing strategies here.

Want to simplify your finances?

Schedule a free demo of FieldRoutes Operations Suite today and take control of your budget.